The Environment and Challenges of the Indian Machine Tool Market (Part I)

In recent years, India has focused on developing localized supply chains for electronic manufacturing and electric vehicles and is actively promoting the "Make in India" policy, aiming to increase the manufacturing sector's contribution to GDP to 25%. These initiatives are expected to drive growth in demand for mechanical equipment such as machine tools and industrial machinery. This series of articles is divided into two parts: Part I analyzes the environment and general overview of the mechanical market in India, while Part II will discuss the opportunities and challenges within the Indian mechanical market to help enterprises seize market opportunities and pre-plan strategies to meet challenges.

India's Overall Market Economic Momentum

(I) India’s Economic Growth Overview and Drivers

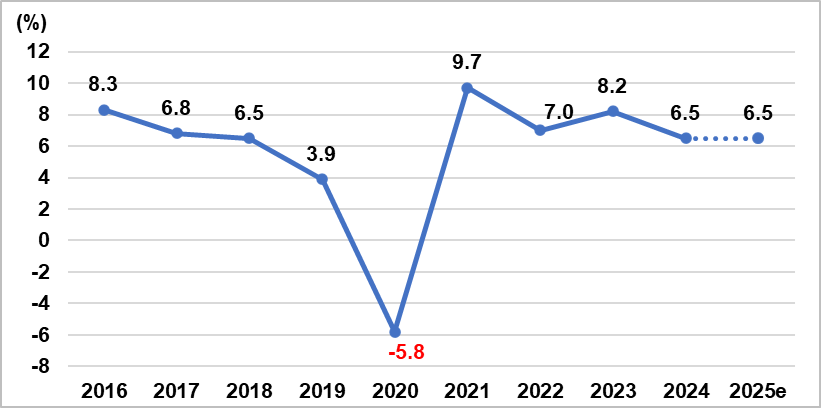

As an emerging economy, India is currently in a phase of rapid economic growth. According to IMF data, the economic growth rate dropped to $-5.8\%$ in 2020 due to the COVID-19 pandemic, rebounded to $9.7\%$ in 2021, and continued rapid growth in 2022 and 2023. The economic growth rate is projected to cool down to $6.5\%$ in 2024, with an estimated growth rate of $6.5\%$ in 2025.

[Figure 1: India's Economic Growth Rate, 2016–2025]

Source: IMF; Compiled by IEK Consulting, ITRI (03/2025)

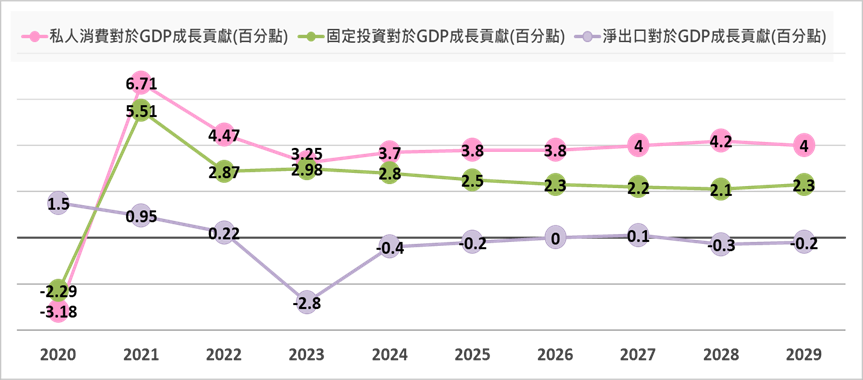

Based on the EIU analysis of GDP growth contributions, India's main economic growth drivers come from consumption and investment. The primary reasons for this growth include continued moderate growth in domestic consumption, sustained increase in investment in infrastructure and manufacturing (electronics, electric vehicles, pharmaceuticals, etc.), and the impetus from growth in exports of pharmaceuticals and consumer electronics.

[Figure 2: GDP Expenditure Contribution to Growth, 2020–2029]

Source: EIU; Compiled by IEK Consulting, ITRI (03/2025)

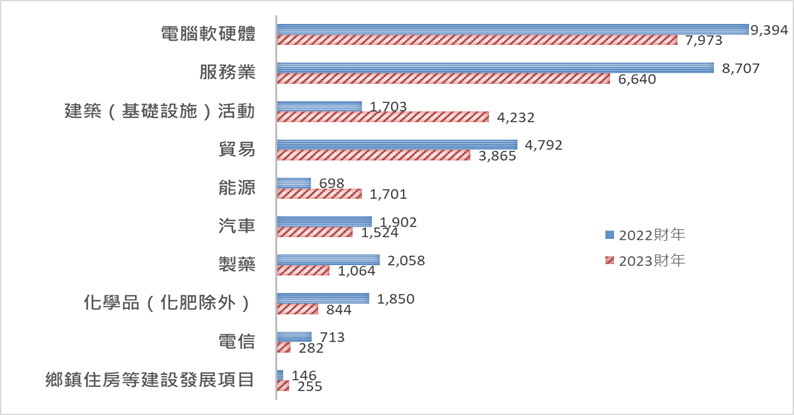

(II) Overview and Sectors of Foreign Direct Investment (FDI) in India

According to data from the Department for Promotion of Industry and Internal Trade (DPIIT), India's FDI inflows over the past five years ranged between $40 billion and $60 billion. The total FDI amount for the 2023 fiscal year was $44.42 billion, a decrease of $3.5\%$ from the previous year. The top three investing countries are Singapore ($11.77 billion), Mauritius ($7.97 billion), and the United States ($4.99 billion). The top three popular investment sectors are Computer Software and Hardware ($7.97 billion), Services Sector ($6.64 billion), and Construction ($4.23 billion). Key manufacturing sectors receiving foreign investment include computer software and hardware, automotive, and infrastructure.

Since 2014, the Indian government has gradually implemented a liberalized foreign investment regime, committed to attracting foreign capital by providing more incentives and simplifying regulations. India offers fiscal incentives to foreign enterprises, including tax benefits, preferential tariffs on imported capital goods, Special Economic Zones (SEZs), signing Bilateral Investment Protection Treaties with investing countries, and subsidies for establishing R&D facilities. In addition to the traditional service and software industries, foreign investment is expected to continue expanding into areas such as infrastructure, telecommunications, automotive, energy, and domestic trade.

[Figure 3: India's Main FDI Investment Sectors, FY 2022–2023 (US$ Million)]

Note: India's fiscal year runs from April of the current year to March of the next year (e.g., April 2023 to March 2024 is FY 2023); Ranking based on FY 2023 values. Source: India DPIIT; Compiled by IEK Consulting, ITRI (03/2025)

Industry policies introduced before 2024 primarily promoted electronic manufacturing. Starting in 2024, the production incentive policies are expanding to EV-related industries, including the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI) and the Electric Mobility Promotion Scheme (EMPS 2024). According to a Bloomberg report on January 8, 2025, India's Ministry of Electronics and Information Technology recommended providing budget incentives of at least 230 billion rupees (about $2.7 billion) and further lowering import tariffs to accelerate investment by local smartphone supply chain manufacturers. The incentive products target smartphone components, including microprocessors, memory, storage devices, multi-layered PCBs, camera components like lenses, and lithium-ion batteries.

Given India's recent focus on developing electronic manufacturing and localized EV supply chains, and its active promotion of the "Make in India" policy, the primary focus industries are smartphone-related electronic manufacturing, subsequently extending to ICT products, semiconductors, and electric vehicles. India will continue to strive for increased local manufacturing ratios, which is expected to continuously influence the development direction and investment layout of related foundational machinery industries.

India's Machinery Market Overview

(I) India's Machinery Market Size and Segmentation

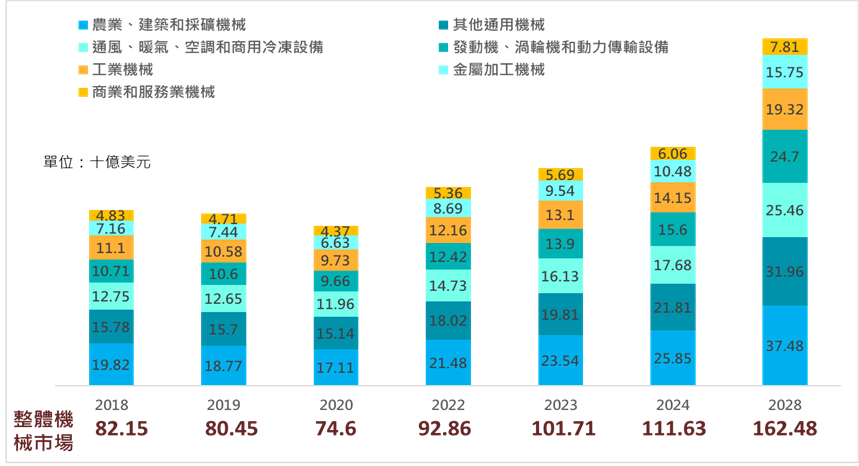

According to estimates from research institutions like TRC, Technavio, and Euromonitor, India's machinery market is growing rapidly. TRC segments the Indian machinery market into: Agriculture, Construction, and Mining Machinery; Industrial Machinery; Commercial and Service Industry Machinery; Ventilation, Heating, Air Conditioning, and Commercial Refrigeration Equipment; Metalworking Machinery; Engines, Turbines, and Power Transmission Equipment; and Other General Machinery.

According to Indian government statistics, the Indian machinery market grew from $82.15 billion in 2018 to $101.71 billion in 2023, with a CAGR of about $4.36\%$. Using this as a baseline, TRC projects the future Indian machinery market to reach $162.48 billion by 2028, calculated at a CAGR of $9.82\%$ from 2023.

-

The largest segment is Agriculture, Construction, and Mining Machinery, projected to reach $37.48 billion by 2028.

-

Other General Machinery is the second largest, estimated to reach about $31.96 billion by 2028, with a projected CAGR of about $10.04\%$.

-

The market for Ventilation, Heating, Air Conditioning, and Commercial Refrigeration Equipment is estimated to reach $25.46 billion by 2028.

-

The market for Engines, Turbines, and Power Transmission Equipment is expected to reach $24.7 billion by 2028.

-

The Metalworking Machinery market is expected to grow from 2023 at a CAGR of $10.55\%$, reaching $15.75 billion by 2028.

-

The market for Commercial and Service Industry Machinery is expected to grow from 2023 at a CAGR of $6.54\%$, reaching $7.81 billion by 2028.

-

The Industrial Machinery market grew from $11.1 billion in 2018 to $13.1 billion in 2023 (CAGR $3.37\%$), and is projected to grow from 2023 at a CAGR of $8.08\%$, reaching $19.32 billion by 2028.

[Figure 4: India's Machinery Market Growth Forecast]

Source: Indian Official Statistics and TBRC Estimates; Compiled by IEK Consulting, ITRI (03/2025)

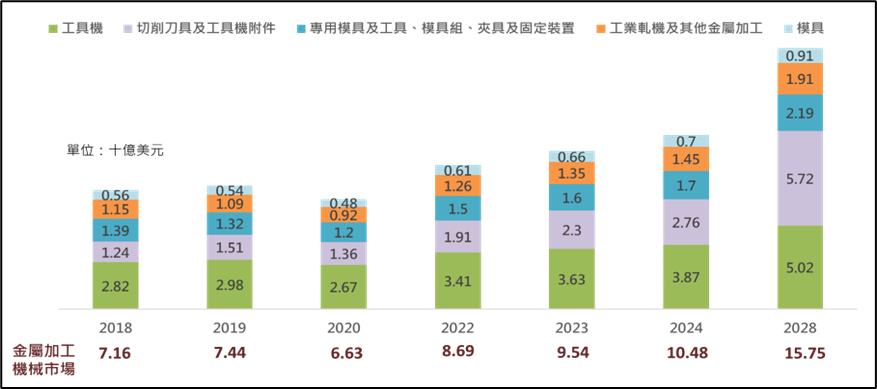

Machine tools are the largest component of the Indian metalworking machinery market, growing from $2.82 billion in 2018 to $3.63 billion in 2023 (CAGR $5.18\%$). It is projected to grow at a CAGR of $6.7\%$, reaching $5.02 billion by 2028.

Cutting tools and machine tool accessories are the second largest component, growing from $1.24 billion in 2018 to $2.3 billion in 2023 (CAGR $13.15\%$). The market size is projected to grow to $5.72 billion by 2028, with a CAGR of $19.99\%$.

Overall, the entire Indian metalworking machinery market grew from $7.16 billion in 2018 to $9.54 billion in 2023 (CAGR $5.91\%$). It is projected to grow to $15.75 billion by 2028, with a CAGR of $10.55\%$.

[Figure 5: India's Metalworking Machinery Market Growth Forecast]

Source: Indian Official Statistics and TBRC Estimates; Compiled by IEK Consulting, ITRI (03/2025)

(II) Application Sectors of the Indian Machine Tool Market

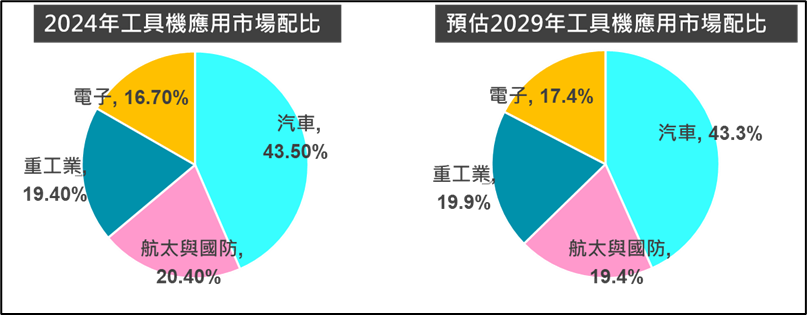

India's machine tool industry mainly relies on demand from motor vehicles and parts, basic iron and steel, rubber, plastics, paper industry machinery, and other specialized machinery. According to statistics compiled from Euromonitor, associations, media, and company research, over $40\%$ of the demand comes from the Vehicle sector. As the automotive industry requires high-precision tools to manufacture engine parts, transmission components, and other critical auto parts, coupled with the surge in India's auto exports in recent years, this is driving the growth of the machine tool market.

From the supply side, the main raw materials for the machine tool industry include basic iron and steel, metal forming, and powder metallurgy. According to Euromonitor statistics, raw material costs account for about $28.5\%$ of the total cost for the machine tool industry. All external demand factors that affect raw material costs, such as economic growth, manufacturing growth, commodity prices, and inflation, will influence the Indian machine tool industry.

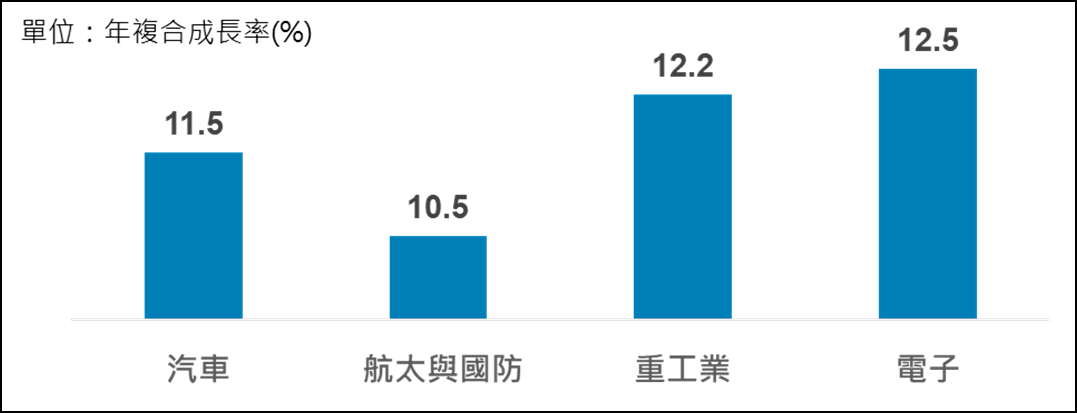

In 2024, the Indian machine tool market mainly supplies the Automotive sector, which accounts for approximately $43.5\%$ of the market, while the Electronics sector has the smallest share at $16.7\%$ (Figure 6). By 2029, the Automotive sector is projected to account for $43.3\%$ of the Indian machine tool market, with an estimated incremental growth of $1.326 billion, remaining the primary application market. While the proportion of the Electronics sector is relatively small (about $17.4\%$), it is expected to have the highest growth rate.

[Figure 6: Machine Tool Application Market Share, 2024]

Source: Technavio Survey; Compiled by IEK Consulting, ITRI (03/2025)

The Electronics sector is projected to have the highest CAGR of $12.5\%$ between 2024 and 2029. However, the Aerospace and Defense sectors are projected to grow the slowest, with an estimated CAGR of $10.5\%$ (Figure 7).

Metal cutting tools are essential equipment for the electronics industry in precision manufacturing processes. Metal forming tools play a crucial role in forming and casting electronic components, while accessories like tool holders and cutting fluids primarily enhance the efficiency and effectiveness of metal cutting and forming processes. Therefore, foreign investment in the electronics industry is expected to boost the application of machine tools in this sector. The growth of India's electronics manufacturing industry is benefiting from significant investment and government measures aimed at promoting domestic production. The growing demand for consumer electronics like smartphones, laptops, and home appliances further drives the need for high-end machine tools.

[Figure 7: Machine Tool CAGR, 2024–2029]

Source: Technavio Survey; Compiled by IEK Consulting, ITRI (03/2025)

Currently, India's main machinery industrial clusters are located in the west (Maharashtra and Gujarat), the south (Tamil Nadu and Karnataka), and the north (Haryana). In the Indian machine tool market, besides some foreign-invested and local medium-to-large enterprises, the largest volume is generally composed of small manufacturers.

India is a major global steel producer, and the upstream material development for machinery equipment is relatively complete. However, the midstream precision components for machinery equipment suffer from backward local production technology and insufficient supply chain support, leading to a long-term reliance on imports for related supply. High-tech machine tools are also heavily imported, with approximately $30\%$ to $35\%$ of all machine tools being supplied through imports.

Through control measures on foreign investment, India creates opportunities for SMEs to grow in collaboration with foreign enterprises, thereby boosting the technological capacity of the Indian machine tool market. This is crucial for increasing the domestic production of high-tech machine tools in India. As the Indian government has strengthened oversight of imported goods through import and export controls and is committed to increasing local production capacity for high-tech machine tools, it is expected that a portion of India's future machine tool imports will be replaced by domestic suppliers.

Summary

In the Indian machine tool market, Computer Numerical Control (CNC) machine tools hold a dominant position compared to conventional machine tools. With the increasing demand for high-precision work across various applications, the adoption rate of CNC machine tools is expected to continue rising. The growing prevalence of CNC machine tools is projected to contribute significantly to the revenue growth of the Indian machine tool market. Furthermore, the future Indian machine tool market, coupled with Artificial Intelligence (AI) and Machine Learning technologies, is expected to become a new mainstream application. Machine tools equipped with relevant algorithms offer performance far superior to modern machine tools used in various applications.