India’s Market Potential, Current Status of the Machine Tool Industry, and Manufacturers' Expansion Strategies

India's Manufacturing Rise and Market Potential

India held its Prime Ministerial election in 2024, with incumbent Prime Minister Narendra Modi seeking a third term. The final election results showed that his party alliance secured 293 seats, confirming Modi's re-election. India's economic development has maintained a high growth rate in recent years. The core industrial policy is "Make in India," which, through a comprehensive set of measures including investment incentives and import tariffs, encourages foreign companies to invest locally with the goal of establishing India as a global manufacturing hub. The primary focus sectors are Information and Communication Technology (ICT) electronics and the automotive industry.

The global supply chain system was highly concentrated over the past few decades due to China's status as the "World's Factory." China's rise was attributed to five major advantages: low production costs, complete manufacturing infrastructure, a large labor force, export-oriented policies, and government support measures. However, geopolitical shocks since 2018—including the US-China trade war, the COVID-19 pandemic, and the Russia-Ukraine war—have forced multinational corporations to re-examine supply chain risk management, leading to four major transformation trends:

-

Integration of Digitalization and Automation: Utilizing technologies such as the Internet of Things (IoT), AI, and blockchain to enhance supply chain transparency. Examples include real-time data analytics to optimize inventory management and cloud platforms to strengthen cross-national collaboration, reducing the risk of supply chain disruption and lowering operating costs.

-

Deepening Sustainability and ESG: Embedding environmental and social responsibility into the supply chain, such as carbon footprint tracking and green logistics planning, and improving supplier ESG ratings through third-party certification to meet the ethical expectations of investors and consumers.

-

Regionalization and Short Chain Layout: The US and Europe are promoting Friend-Shoring, shifting strategic industries like semiconductors and pharmaceuticals to politically allied nations. TSMC setting up plants in the US and Japan is a typical example. This model shortens transportation cycles and diversifies geopolitical risk but requires overcoming challenges such as cultural differences and rising costs.

-

Localization and Customization Transformation: Consumer electronics and biotechnology industries are accelerating "near-market production," combining 3D printing and smart manufacturing technologies to achieve small-batch, high-mix production. For instance, the Indian market is developing specific product specifications tailored to regional needs.

Leveraging its demographic advantage (median age 28.2 years) and expanding consumer market, India is emerging as a preferred alternative base for multinational corporations seeking to diversify risk. Three key tailwinds are currently observed: demographic dividends driving domestic demand, a digital consumption revolution, and favorable policy support.

In terms of demographic dividends driving domestic demand, young adults aged 20-33 account for 33% of the total population, driving the segment with an annual income over $10,000 to reach 100 million people by 2027, leading to a surge in demand for consumer electronics and luxury goods. Regarding the digital consumption revolution, the popularization of social commerce and BNPL (Buy Now, Pay Later) models is expected to propel India past Japan to become the world's third-largest consumer market by 2027, attracting moves like Apple's opening of direct stores and Tata Starbucks' plan for 1,000 new stores over five years. Finally, favorable policy support is evident, with the 2023 budget focusing on stimulating private consumption and employment, coupled with the Production Linked Incentive (PLI) scheme to attract foreign investment into sectors like electronics and renewable energy.

The global supply chain is shifting towards regionalization, digitalization, and sustainability. India, with its vast and young demographic dividend, has become a new focal point for global business expansion. Multinational corporations are actively setting up operations in the Indian market, driving supply chain adjustments, and positioning India to play a more crucial role in the global economy.

Current Status and Industrial Clusters of the Indian Machine Tool Industry

Industry Status

According to 2023 statistics from the Indian Machine Tool Manufacturers' Association (IMTMA), India is the world's ninth-largest producer and seventh-largest consumer of machine tools. The rapid economic growth, driven by industries such as textiles, heavy industries, food processing, chemical medicine, and energy, is fueling the demand for machine tools and promoting industrial development. India is expected to transition from an importing country to a producing country in the future.

However, local Indian machine tools currently meet only about 40% of the demand; the remainder must be imported, resulting in a significant trade deficit. This indicates vast potential for growth in the local market.

India's machinery and equipment industry benefits from a complete upstream raw material supply chain, possessing rich iron ore and steel production capabilities. Midstream steel processing attracts international contract manufacturing due to low technological barriers and cheap labor. However, the domestic supply chain for downstream precision machining and electrical/control components is weak, forcing many companies to rely on imported components for final assembly.

Furthermore, the Indian machine tool industry faces several challenges that affect its competitiveness and pace of technological upgrading, including high electricity costs, power outages, shortage of skilled professionals, expensive machinery, and inadequate safety standards.

India has approximately 1,000 enterprises manufacturing machine tools, systems, and components. Twenty large enterprises account for 70% of the total national output value, with the rest being Small and Medium-sized Enterprises (SMEs). Three-quarters of enterprises have obtained ISO certification, and some have the CE mark to expand into the European market. Large enterprises mainly produce heavy industrial equipment, while SMEs primarily focus on auxiliary equipment, with most still using low-cost, low-technology, semi-automatic equipment and insufficient safety precautions. Due to limited capital, SMEs cannot afford expensive equipment and thus rely heavily on imported machine tools, particularly machining centers, grinding machines, drilling machines, and milling machines.

In terms of market demand, cutting machines have the highest share. CNC machine tools account for over 80% of the output value, with a growth rate far exceeding conventional types. For forming machines, hydraulic presses dominate, though CNC types are lower than conventional types in quantity, output value, and growth rate, with their unit price being only about half of the conventional type.

Overall, the Indian machine tool market has significant room for development. Local companies can enhance competitiveness through technological upgrades and capacity expansion, while foreign companies can leverage this to expand their market share. The IMTMA is actively promoting technological development, product innovation, and quality control to raise the standard of the Indian machine tool industry and aid its modernization and international competition.

Machine Tool Policy and Industrial Clusters

Various Indian states (such as Maharashtra, Gujarat, Tamil Nadu, etc.) are actively attracting investment in the machine tool industry, benefiting from the government's "Make in India" initiative. This program expands preferential tariffs for CNC metal processing machines and offers policies such as 100% Foreign Direct Investment (FDI) and exemption from industrial licenses to promote machine tool manufacturing and imports. Furthermore, India considers exports a national priority. Currently, the basic customs duty on imported machine tools is 7.5%, which, combined with the Social Welfare Surcharge and IGST, results in a total tax rate of 27.735% for machine tool products under HS codes 8456-8463.

The Indian machine tool industry is widely distributed across the country, but the main production bases are concentrated in states such as Maharashtra, Gujarat, Karnataka, Andhra Pradesh, Tamil Nadu, Haryana, and Punjab. Each state actively attracts investment, forming industrial clusters. In addition, Uttarakhand has also actively promoted industrial development in recent years, gradually becoming an important location for machine tool manufacturing.

-

Maharashtra: This state is India's economic powerhouse, with major industries including engineering, automotive, and textiles. Pune is a critical city for machine tool manufacturing. Pune and Mumbai form a strong industrial corridor, gathering world-renowned companies like Volkswagen, Daimler, Mahindra & Mahindra, and Bajaj Auto, creating a complete supply chain system. The Chakan Industrial Area is one of India's main manufacturing centers due to its favorable industrial policies, infrastructure, port proximity, and sufficient technical talent.

-

Gujarat: This is one of India's most important industrial zones. Rajkot is the core area for machine tool manufacturing, home to numerous traditional machine tool producers whose products cover CNC machining centers, lathes, hydraulic presses, mechanical presses, and special-purpose machine tools. Local famous machine tool manufacturers include Jyoti CNC, Macpower CNC, and Singhal Power Press. Ahmedabad focuses on casting, forging, auto parts, and sheet metal packaging. Furthermore, Jamnagar is a brass parts manufacturing center, while Vadodara and Surendranagar are developing machinery manufacturing.

-

Karnataka: This state is the core hub for machine tool manufacturing in India. Bangalore produces about 60% of all machine tools in India, with an estimated output value exceeding $300 million. Major local industrial zones include Peenya, Abbigere, and Bommasandra, focusing on metal-cutting machine tools and high-value machinery manufacturing. The region has a complete industrial chain, including public sector enterprises, multinational corporations, and numerous SMEs, creating a highly competitive market environment. To further promote the machine tool industry's development, the Indian government announced the establishment of the Tumakuru Machine Tool Park in 2018, aiming to enhance the competitiveness of the local supply chain, meet the needs of machine tool manufacturers and related component suppliers, and foster technological innovation and product diversification.

-

Andhra Pradesh: This state is an important base for auto parts production in India, with numerous international auto manufacturers setting up plants, such as South Korea's Kia Motors, which has invested $2 billion to establish a local production base. The state also boasts rich port resources, including major ports like Visakhapatnam and about 14 medium- and small-sized ports, providing excellent export conditions for machine tools and related industries. Additionally, Andhra Pradesh has a high-quality labor force with a relatively high literacy rate, which contributes to industrial development and technological advancement.

-

Tamil Nadu: This state is one of the main investment locations for Taiwanese machinery companies in India, with Chennai and Coimbatore being the two major industrial centers. Tamil Nadu is home to the Madras Machine Tools Manufacturers' Association (MMTMA), which plays a key role in promoting the local machine tool industry's development, working closely with the government, regulatory bodies, financial institutions, and other industry organizations to enhance competitiveness, productivity, and efficiency. Although Coimbatore has a domestic airport, it is still a secondary city in India and currently has no Taiwanese machinery companies established there. However, the region still holds development potential, particularly in precision machinery and component manufacturing. The area also hosts the Mahindra World City Origins near Chennai, an investment by the Mahindra Group, and industrial parks developed by the Indospace Group near Chennai and Coimbatore. Invest India, the investment promotion center of the Indian Ministry of Commerce and Industry, has a Taiwan Plus team to assist Taiwanese companies in their India expansion, providing written assessments of factory location areas and helping arrange site visits for land and factory buildings.

The Indian government is actively promoting manufacturing development through the "Make in India" policy and offering preferential measures to attract foreign investment, which benefits the machine tool industry. Key policies include allowing 100% FDI, lowering industrial barriers for machine tool manufacturing, reducing tariffs, and strengthening infrastructure construction. While the Indian machine tool market still faces technological and capacity challenges, with some high-end equipment requiring imports, the industry is gradually increasing its international competitiveness through government support and the development of industrial clusters, ensuring its future as an important participant in the global machine tool market.

India's Machine Tool Import Value and Main Machine Types

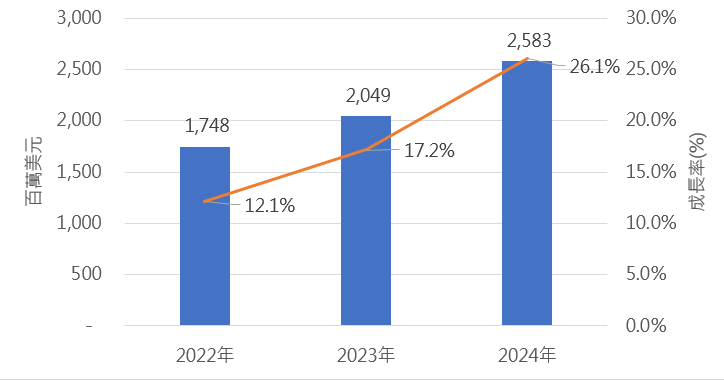

According to Global Trade Atlas, in 2024, India's machine tool imports reached $2.58 billion, representing a 26.1% growth compared to 2023 (Figure 1).

-

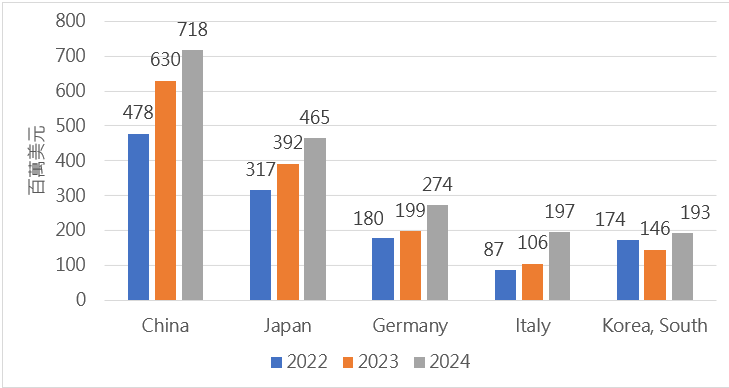

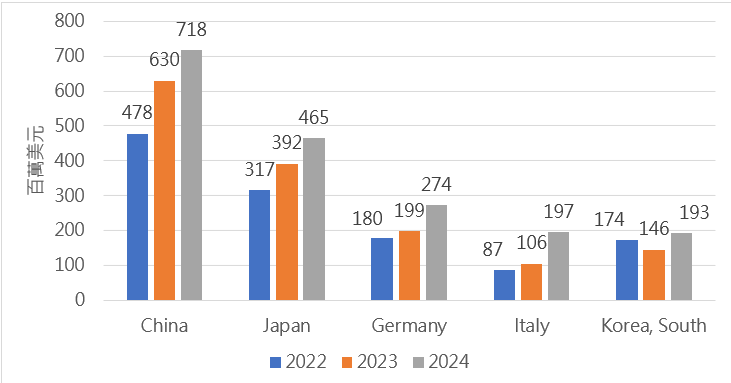

The largest importing country is China, with an import value of $718 million, growing 14.1% from 2023, accounting for 27.8% (Figure 2).

-

The second largest is Japan, with an import value of $465 million, growing 18.7% from 2023, accounting for 18.0%.

-

The third largest is Germany, with an import value of $274 million, growing 37.7% from 2023, accounting for 10.6%.

-

The fourth largest is Italy, with an import value of $197 million, growing 85.4% from 2023, accounting for 7.6%.

-

The fifth largest is South Korea, with an import value of $193 million, growing 32.0% from 2023, accounting for 7.5%.

-

Taiwan is the sixth largest, with an import value of $156 million, growing 21.6% from 2023, accounting for 6.1%.

In terms of machine types, the largest category of machine tool imports in 2024 was forging, stamping, and forming machine tools, valued at $818 million, representing a 61.9% growth from 2023, accounting for 31.7% (Figure 3).

-

The second largest is machining centers, valued at $445 million, growing 2.3% from 2023, accounting for 17.2%.

-

The third largest is grinding machines, valued at $323 million, growing 51.0% from 2023, accounting for 12.5%.

-

The fourth largest is lathes, valued at $279 million, growing 18.0% from 2023, accounting for 10.8%.

-

The fifth largest is EDM, laser, and ultrasonic machine tools, valued at $226 million, declining 24.1% from 2023, accounting for 8.8%.

[Figure 1: India's Machine Tool Import Value Statistics, 2022–2024]

[Figure 2: Top Five Countries by India's Machine Tool Import Value, 2022–2024]

Figure 3: Top Five Machine Types by India's Machine Tool Import Value, 2022–2024

Views of Representative Taiwanese Machinery/Machine Tool Companies on New Indian Business Opportunities and Market Expansion Strategies

Regarding Taiwanese companies entering the Indian market, Fair Friend Group (FFG) stated that FFG MAG India is located in Bangalore, within the Hardware Aerospace and IT Park, and is committed to building a machine tool manufacturing hub in South Asia, adjacent to the TIP Park developed by Taiwanese business group Surbana Jurong. FFG believes now is a prime opportunity to expand into the Indian market, as buyers are procuring at reasonable prices. FFG adjusts its strategy based on market dynamics: the Chinese market is managed by FFG China, focusing on domestic demand, while the Indian market is managed by FFG India. Products imported from Taiwan incur a total tax burden of about 28%. While the import of used machinery requires inspection and appraisal by a registered engineer, FFG is rarely involved in this business. For new machinery, the local content ratio is flexibly adjusted based on demand. Currently, FFG India's machinery localization rate reaches 65% to 70%, and products are sold after testing and verification. FFG projects that the Indian machine tool market is expected to grow fivefold over the next decade, with the aerospace industry being the latest development focus, mainly serving domestic demand. Other growth areas include railway equipment and die-casting molds, which have export potential. Indian Railways is investing $25 million to promote the domestic production of wheelsets and is implementing three major economic railway corridor projects to enhance logistics efficiency and reduce costs.

Fu Chun Shin (FCS) India is located in Ahmedabad and adopts a "train first, then dispatch" strategy, where Indian employees trained in Taiwan return home to serve as key personnel. The company transplants Taiwan's quality management processes and uses remote video management, with local Indian management assisting operations. The FCS plant in India is the group's first overseas factory, dedicated to establishing a complete supply chain and factory management system. Following the end of the pandemic, production capacity is gradually increasing and is expected to surpass the Taiwan factory. Although the Indian factory was still operating at a loss in the first half of 2023, it achieved a small profit in the second quarter. The key challenge for the FCS Indian plant is the development of machining equipment; the company is evaluating whether to build its own machining department or find local partners. However, there are still issues with quality control of local Indian machining, as suppliers are reluctant to acknowledge quality defects, and infrastructure bottlenecks also affect capacity enhancement. Furthermore, workers show low willingness to work overtime and lack accommodation needs. FCS believes that for "Make in India" to take off, local machining capability must be improved; relying solely on foreign companies is unsustainable, and local players must invest resources to promote industrial development.

Hanbell Precise Machinery, established in 1994, manufactures compressors at its Guanyin plant in Taoyuan and vacuum pumps at its Taichung plant. Its products cover refrigerant compressors, air compressors, and dry vacuum pumps, widely used in refrigeration/air conditioning, automation, and vacuum processes. Hanbell markets globally under the "Hanbell" brand. Recognizing the importance of the Indian market, Hanbell previously stationed personnel in Mumbai for expansion. In 2022, it leased space in Bangalore to establish its Indian subsidiary, Comer Precise Machinery India, which was officially registered in 2023 and currently focuses mainly on customer maintenance. Hanbell India advises that companies unfamiliar with the Indian market should start with trading and make good use of local Indian executives. Market strategies should be decided by the Taiwan headquarters, with the Indian branch focusing on local cultivation. When leading Indian employees, priority should be given to developing local executives, and the salary structure should feature a higher base salary followed by a bonus system to enhance stability. Moreover, a foundation of cooperation with local buyers should be established before setting up a factory to mitigate risks.

As India's "Make in India" policy drives manufacturing upgrade, it has become one of Asia's most promising markets. Furthermore, with 60% of India's machine tools relying on imports, the supply-demand gap is evident. Taiwanese companies should especially target important and high-potential application areas like the automotive manufacturing industry (accounting for over 7% of GDP) and aerospace.

A synthesis of the common strategic practices and market views of the three representative Taiwanese machinery/machine tool companies mentioned above is summarized as follows:

-

Establish Local Presence and Cultivate the Market

-

Set up local branches or factories: Both FFG and FCS have established factories in India, ensuring market penetration and supply chain completeness.

-

Prioritize a trading model entry: Hanbell suggests that companies unfamiliar with the market should start with trading and gradually expand operations.

-

Clarify regional market strategies: FFG separates the China market (focused on domestic demand) from the India market (independently operated) to ensure flexible local market adaptation.

-

-

Strengthen Localized Production and Supply Chain Management

-

Increase the proportion of localized products: FFG's Indian factory has a machinery localization rate of 65%–70%, which helps reduce tariffs (approx. 28%) and enhance competitiveness.

-

Improve machining capability and quality control: FCS noted that local Indian machining quality remains flawed, and local supply chain development requires strengthening quality management mechanisms.

-

Ensure a stable supply chain: FCS is evaluating building its own machining department or finding reliable local partners to solve supply issues.

-

-

Cultivate Local Talent and Improve Management Efficiency

-

Establish local management: FCS adopts a "train first, then dispatch" strategy, having Indian employees return to hold key positions and transplanting the Taiwanese management model.

-

Enhance local employee stability: Hanbell suggests a higher base salary and the introduction of a bonus system to increase employee stability and performance.

-

Remote video management and local executive assistance: FCS utilizes remote video management supported by local Indian management for operations.

-

-

Grasp Industry Trends and Government Policies to Find Growth Opportunities

-

Focus on growth industries: Aerospace, railway equipment, and die-casting molds are potential markets, such as Indian Railways' $25 million investment in promoting domestic production of wheelsets.

-

Government infrastructure and economic corridor projects: The three major economic railway corridor projects help reduce logistics costs and improve manufacturing competitiveness.

-

India's market potential is large but requires long-term commitment: FFG Group predicts the Indian machine tool market could grow fivefold within ten years, requiring early planning.

-

-

Plan Carefully Before Establishing a Factory to Mitigate Operational Risk

-

Establish a cooperation foundation with local buyers: Hanbell advises ensuring stable customer relationships before setting up a factory to reduce market risk.

-

Consider local labor culture and infrastructure limitations:

-

FCS points out that workers have a low willingness to work overtime and lack strong accommodation needs, requiring adaptation to local labor culture.

-

Infrastructure bottlenecks can affect production capacity enhancement, necessitating evaluation of logistics and operational costs.

-

-

In summary, while the Indian market has growth potential, it is intensely competitive and requires adaptation to the local culture. Taiwanese machinery/machine tool companies interested in expanding into India can reference the five common strategies of these pioneering companies to effectively expand into the local market and maintain competitiveness.