New Geopolitical Dimension: 2023 Gardner Global Production and Consumption Report

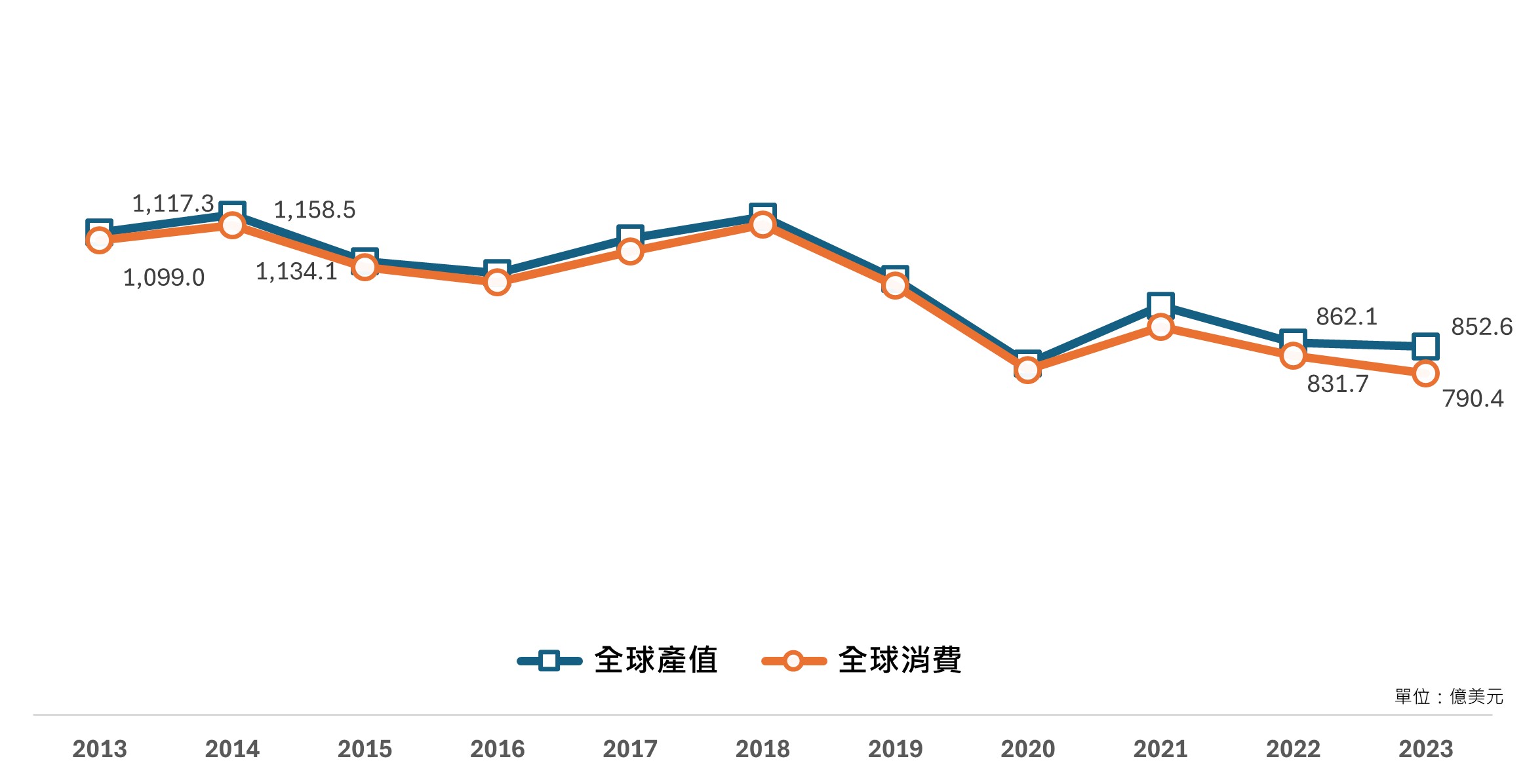

Gardner Publication, Inc. recently released its global machine tool production and consumption survey report, indicating that overall changes in the machine tool market in 2023 were minimal. According to the report data, global machine tool production in 2023 totaled approximately $85.3 billion, representing a 1.1% decline compared to 2022; global machine tool consumption amounted to about $79 billion, down 5% from 2022.

|

Global factors such as inflation, rising interest rates, and China’s slower-than-expected economic recovery weakened end-product demand, leading to a slowdown in manufacturing activity across countries. Additionally, geopolitical risks—including the expansion of U.S.-China trade barriers, the Russia-Ukraine war, the Israel-Hamas conflict, and the Red Sea crisis—have disrupted traditional industry cycles and global trade order, making investment and consumption more conservative. Consequently, global machine tool consumption in 2023 was slightly sluggish. The top machine tool consuming countries were ranked as follows: China, the United States, Germany, Italy, Japan, India, South Korea, Mexico, Turkey, and Taiwan.

China’s economic slowdown and structural adjustments impacted manufacturing investment and expansion. In 2023, China’s machine tool consumption totaled $25.71 billion, a 9.6% decline from 2022, down nearly $2.5 billion. Despite weak demand, China remained the world’s largest machine tool consumer, with consumption nearly double that of the second-ranked United States.

The United States, supported by policies promoting manufacturing revival and supply chain stability, implemented tax incentives and subsidies that encouraged capital spending. As a result, U.S. machine tool consumption was relatively strong, reaching $12.83 billion in 2023, an 8.2% increase from 2022 (up about $1.06 billion).

Among other major consuming countries, Mexico performed notably well. Benefiting from robust U.S. economic activity and its role as a gateway to the North American market and supply chain, Mexico’s machine tool consumption reached $2.44 billion in 2023, up 11.6% from 2022. Turkey also saw significant growth, driven by regional supply chain restructuring and its strategic geographic position spanning Europe and Asia. Turkey’s machine tool consumption totaled $1.9 billion in 2023, a sharp 16% increase from 2022.

Global Machine Tool Production

Although global machine tool production slightly declined in 2023, overall performance remained relatively stable. Except for Germany and Japan swapping ranks, other major producing countries maintained their positions: China, Germany, Japan, the United States, Italy, South Korea, Taiwan, Switzerland, India, and Spain. Germany, the U.S., and Spain recorded stronger growth than other countries, while China, Japan, and Taiwan saw simultaneous declines in production value and global share.

Japan’s machine tool production totaled $9.79 billion in 2023, down 8.9% from 2022. Although yen depreciation improved price competitiveness internationally, rising raw material, energy, and labor costs offset this advantage. Combined with weak global conditions and sluggish domestic growth momentum, Japan’s machine tool output decreased.

Spain, the EU’s second-largest automobile producer, faced economic challenges from the pandemic, supply chain disruptions, and inflation. To counter these, the Spanish government secured EU funding under the “Strategic Recovery and Transformation Plan (PERTE)”, focusing on green transportation and energy transition to drive automotive technology upgrades. Spain’s machine tool production reached $1.49 billion in 2023, up 21.6% from 2022.

Global Machine Tool Exports

In 2023, the top ten machine tool exporting countries were Germany, China, Japan, Italy, South Korea, Taiwan, Switzerland, the United States, Spain, and Belgium. Except for Japan and Taiwan, most major exporters recorded growth.

- Germany: $8.23 billion (+8.7%); main exports: machining centers (26.4%), EDM/laser/ultrasonic machines (16.3%), forging/press machines (14.4%). Top destinations: China (18.1%), U.S. (14.2%), Italy (6.8%).

- China: $7.78 billion (+16.9%); main exports: EDM/laser/ultrasonic machines (29.3%), forging/press machines (23.7%), lathes (12.8%). Top destinations: Russia (18.3%), India (7.8%), U.S. (7.4%).

- Japan: $6.63 billion (-11%); main exports: machining centers (36.9%), lathes (23.6%), EDM/laser/ultrasonic machines (15.5%). Top destinations: U.S. (25%), China (24.2%), India (5.5%).

- Italy: $4.22 billion (+18.6%); main exports: forging/press machines (37%), machining centers (13.4%), EDM/laser/ultrasonic machines (11.9%). Top destinations: U.S. (14.6%), Germany (8.9%), China (7.4%).

- South Korea: $2.92 billion (+15.4%); main exports: lathes (34.1%), forging/press machines (27.2%), machining centers (19.8%). Top destinations: U.S. (27.4%), China (9.4%), Germany (7.1%).

Global Machine Tool Imports

The top ten importing countries in 2023 were United States, China, Germany, Mexico, Italy, Turkey, India, France, Netherlands, and Taiwan, with Mexico and Turkey’s imports accounting for over 90% of their consumption.

- United States: $6.49 billion (+9.3%); main imports: EDM/laser/ultrasonic machines (29.3%), forging/press machines (23.7%), lathes (12.8%). Top sources: Japan (25.1%), Germany (17.6%), South Korea (9.9%).

- China: $6.1 billion (-11.3%); main imports: machining centers (33.7%), EDM/laser/ultrasonic machines (14.9%), forging/press machines (13%). Top sources: Japan (33.4%), Germany (25.3%), Taiwan (11%).

- Germany: $2.78 billion (-3.5%); main imports: EDM/laser/ultrasonic machines (22.5%), lathes (20.3%), machining centers (17.9%). Top sources: Switzerland (28.5%), Japan (12.9%), Italy (7.4%).

- Mexico: $2.43 billion (+11.6%); main imports: forging/press machines (35.5%), machining centers (21.2%), EDM/laser/ultrasonic machines (15.9%). Top sources: U.S. (19.3%), Japan (16%), Germany (15.4%).

- Italy: $1.9 billion (-2.4%); main imports: machining centers (24.7%), lathes (24%), EDM/laser/ultrasonic machines (15.5%). Top sources: Germany (29.9%), South Korea (10.9%), Belgium (10.2%).

Outlook

According to the World Bank’s latest Global Economic Prospects report, global economic growth from 2020 to 2024 will be the slowest five-year period since the early 1990s. As inflationary pressures ease and major economies near the end of their rate-hike cycles, coupled with supply chain diversification driven by geopolitical shifts, market demand is expected to gradually recover. Future demand will focus on net-zero carbon emissions, smart technologies, digital transformation (DX), and green transformation (GX)—aligning with Taiwan’s machine tool industry trends.

Insights from TMTS 2024 Taiwan International Machine Tool Show reveal that Taiwanese manufacturers have embraced digital and green technologies, enabling higher production efficiency, precision machining, and sustainable development. Innovative low-carbon and eco-friendly products and technologies were showcased, offering comprehensive solutions to global customers. The industry hopes for an early economic rebound, allowing Taiwan’s machine tool sector to continue demonstrating progress and innovation.