The Rise of Central and Eastern European Industries and the Reconfiguration of Europe

As a former integral part of the Soviet economic bloc, Eastern Europe played a critical role in heavy industry, leading to a flourishing presence in the automotive and laser sectors. Following the collapse of the Soviet Union, the region underwent economic reforms. Electronic Manufacturing Services (EMS) for industrial electronics and telecommunications equipment have performed exceptionally well in producing defense, medical electronics, high-end consumer products, and cloud storage solutions. Combined with advanced IT solutions, this has attracted many major electronics manufacturers to establish bases there.

Due to the continued strength of heavy industry, international machine tool players are actively investing in the Eastern European market, particularly within aerospace and automotive supply chains. For non-European countries such as China, Taiwan, Japan, and South Korea, Eastern Europe serves as the most vital "beachhead" for entering Europe. It not only bridges the geographical distance but also provides a workforce with high-level technical skills and excellent education. Amidst current geopolitical shifts, it has become a key region for companies looking to diversify market risks. Furthermore, CEE governments are actively creating favorable environments by expanding local power generation, modernizing grid stability, promoting IPOs of state-owned enterprises to introduce public governance innovation, and investing in Agri-Tech to ensure agricultural resilience.

The ongoing confrontation between democracy and autocracy is reshaping not only the flow of products and services but also future technological development and supply chain structures. The era of feasting on "global dividends" has ended, evidenced by the CHIPS Act, "friend-shoring" supply chains, AI chip bans, and scrutiny of tech investments in China.

The world is forming a "Democratic Supply Chain" and an "Authoritarian Supply Chain." While some overlap remains, intervention by the "visible hand" of governments is likely to reduce it significantly. Strategic industries—from semiconductors and EVs to AI, batteries, quantum computing, and cybersecurity—will be the primary battlegrounds. This stance-driven chain reaction is splitting the globe in two. When Switzerland joined sanctions against Russia, it signaled a reversal of traditionally neutral European stances. Concurrently, the EU began pouring resources into CEE. For example, the European Bank for Reconstruction and Development (EBRD) invested €2.35 billion in Central Europe and the Baltic states (CEB) in 2022 to assist in green energy transitions, with Poland, Slovenia, Hungary, and Lithuania being the primary beneficiaries.

Industry 4.0 and the Rapid Growth of the CNC Market

Inherently strong in manufacturing, CEE countries have independently developed precision machinery, automotive, and semiconductor sectors. Foreign Direct Investment (FDI) from Western Europe, Japan, the US, and South Korea has integrated CEE into the global value chain. Influenced by Germany's Industry 4.0, CEE nations are aggressively pursuing digital transformation. According to the IZA Institute, Lithuania, Slovenia, and the Czech Republic are the most advanced in this regard, implementing policies like "Pramonė 4.0," "Smart Industry Platform," and "Průmysl 4.0."

The CNC market in CEE is also benefiting from this growth. Demand for medical devices, EVs, telecommunications, and semiconductor equipment continues to rise. The CNC lathe market is expected to grow significantly due to the European automotive industry's need for customized components (cylinder heads, gearboxes, etc.). To meet EV manufacturing requirements, demand for 5-axis milling machines and precision equipment is increasing. Key players include UNITED GRINDING Group, Mazak, Fanuc, and Bosch Rexroth.

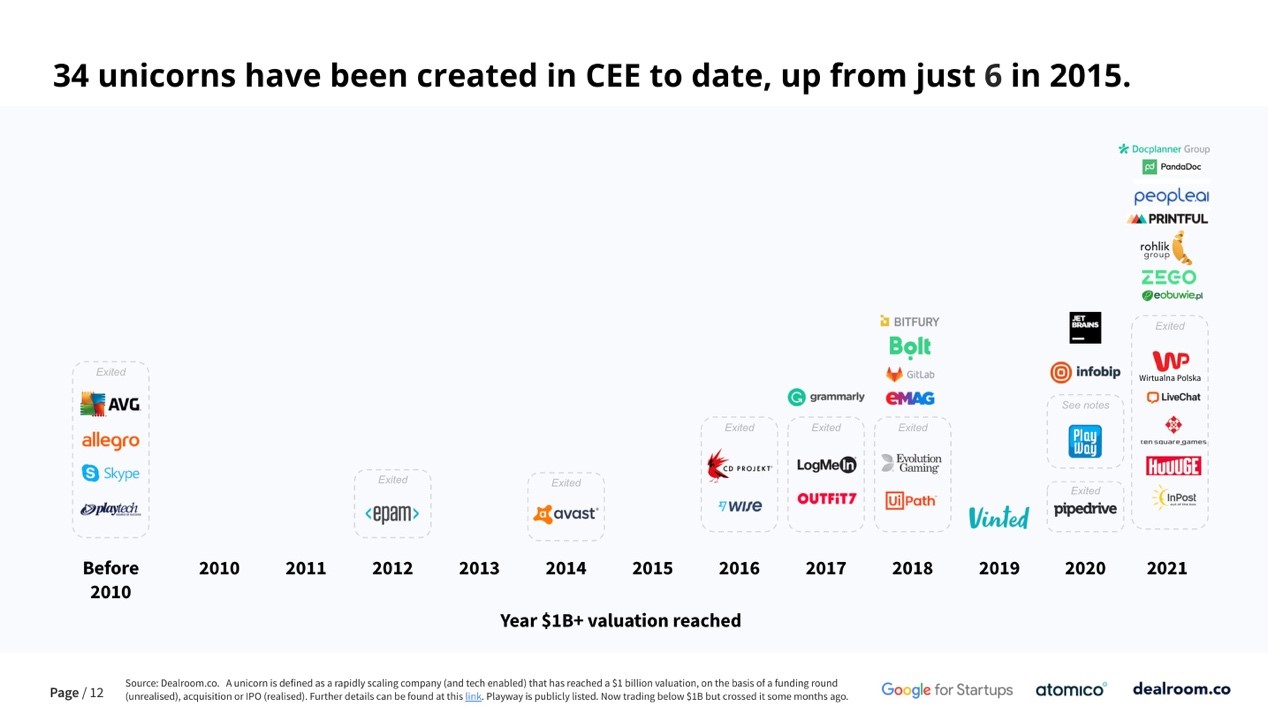

A Booming Startup Ecosystem and the Rise of Unicorns

Beyond heavy industry, the startup ecosystem in CEE—especially in the Baltic states—is often overlooked. Startup valuations in the Baltics grew from €12 billion in 2016 to €46 billion in 2021, a 390% increase. Between 2016 and 2021, the Baltic region produced new unicorns every year, with 14 appearing in 2021 alone. Major international investors, including Intel Capital, Accel, and Insight Partners, have entered the market, focusing on Fintech, mobility, and consumer software. The region's advantage in "Deep Tech" (lasers, advanced materials) is now attracting significant venture capital that previously favored the US or China.

|

Abundant Software Talent: A Strategic Advantage

Eastern Europe possesses over 5.7 million software professionals. Ukraine alone has 200,000 IT specialists, while Poland’s IT market is growing at 300% the rate of India's. Top universities in Ukraine and Poland produce thousands of high-caliber engineers annually who possess strong English proficiency. With reasonable recruitment costs—averaging $20,000 to $30,000 per year—international giants like Google, Meta, and Apple are actively hiring in the region. Advanced manufacturers like Siemens and ABB are also competing for this talent to fuel their smart manufacturing and EV transitions.

Opportunities for Taiwanese Manufacturers in the CEE Automotive Sector

Under international political and economic risks, CEE is becoming a "China + 1" alternative production base. Germany is the most active investor, with German and Austrian corporate investment in the region reaching €76 billion by late 2020. BMW chose Debrecen, Hungary, for a $1 billion plant—its first new European factory in 15 years—citing excellent infrastructure and proximity to supply chain partners. Similarly, Jaguar moved production from the UK to Slovakia.

To address an aging workforce, CEE is adopting automation at a high rate. The International Federation of Robotics (IFR) expects industrial robot stocks in CEE to grow at a CAGR of 22% (compared to 5% in Germany). Slovenia and Slovakia already boast higher robot densities than the global average.

Leveraging the "Democratic Supply Chain" Advantage

Taiwan shares the values of freedom and democracy with CEE countries like Lithuania, Slovakia, and the Czech Republic. To strengthen bilateral ties, Taiwan has established the "Central and Eastern European Credit Fund" (managed by the National Development Council) and the "Central and Eastern European Investment Fund" (managed by Taiwania Capital). These funds assist Taiwanese companies in sectors like semiconductors, lasers, biotech, and EVs.

With deep industrial foundations, low labor and land costs, and EU membership, CEE is an ideal gateway for Taiwanese firms. Whether through smart manufacturing or tapping into the local software talent pool, the "Democratic Supply Chain" offers a strategic opportunity for Taiwan to secure a foothold in the transformed global market. From semiconductors to machinery, the synergy between Taiwan and CEE is poised for significant expansion.