Impact of U.S. Political and Economic Changes on Taiwan’s Machine Tool Industry

The Federal Reserve’s Interest Rate Cuts

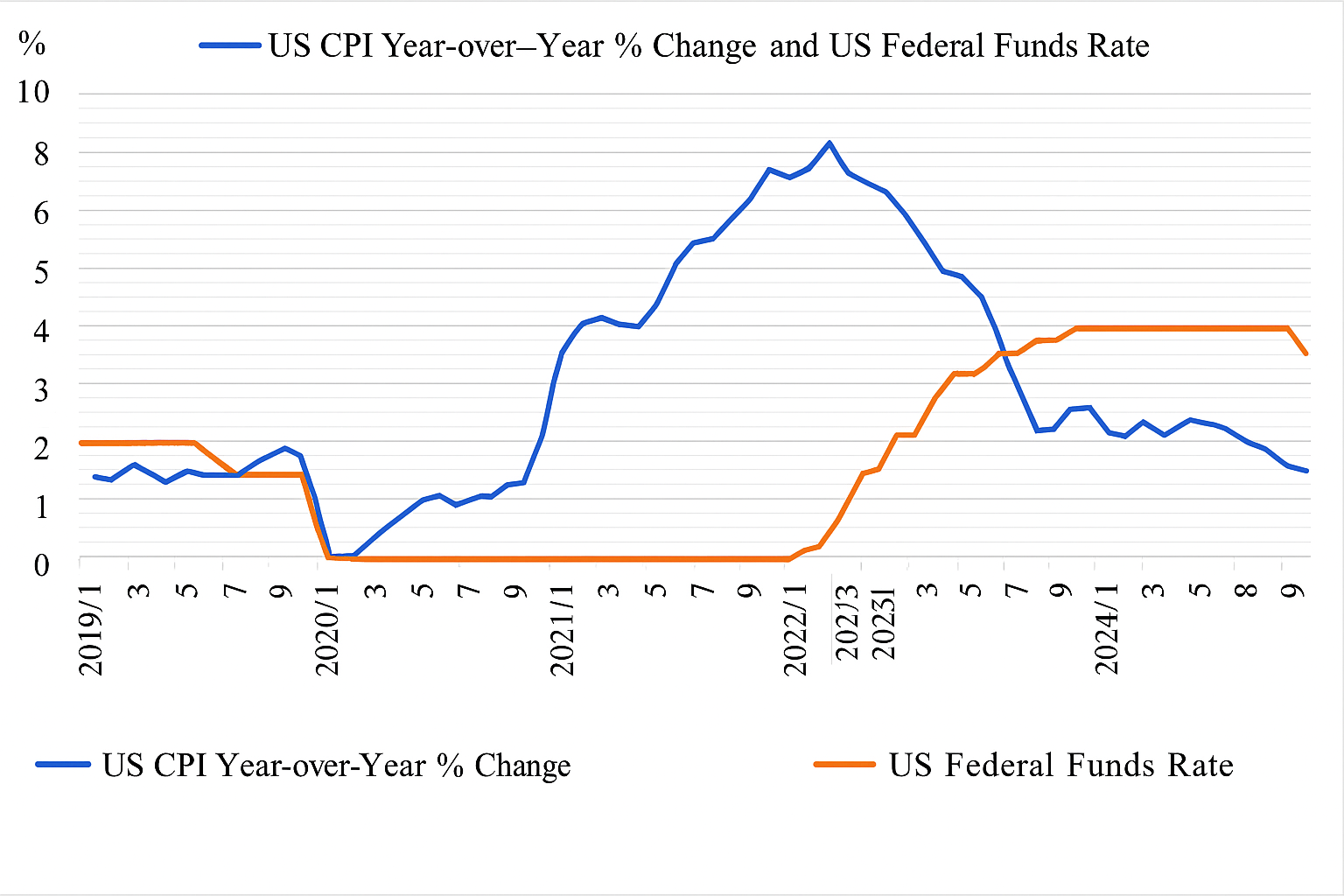

In 2020, the global outbreak of COVID-19 caused a surge in confirmed cases in the United States, severely impacting its economy and financial markets. The U.S. stock market even experienced multiple circuit breakers, forcing the Federal Reserve in March 2020 to cut the benchmark interest rate to zero and implement an unlimited quantitative easing (QE) policy. As a result, the Fed’s balance sheet expanded from $4.2 trillion before the pandemic to $8.9 trillion by December 2021. However, this ultra-loose monetary policy led to a sharp rise in inflation (see Figure 1). To curb inflation, the Fed began aggressive rate hikes in March 2022 and started balance sheet reduction in June, shifting monetary policy back to tightening, which gradually eased inflationary pressures.

|

Source: General Administration of Customs of China; Taiwan Institute of Economic Research Industrial Database (Nov. 2024)

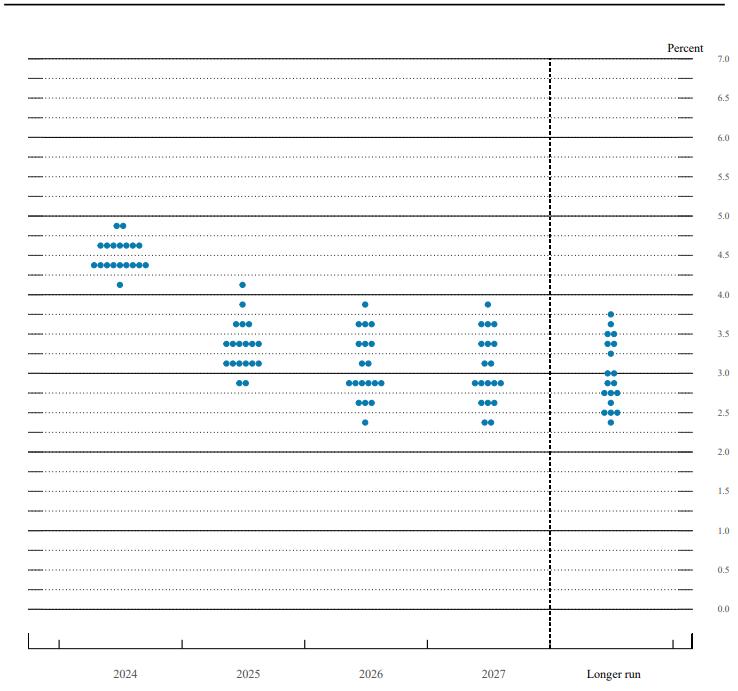

With inflation effectively under control, the Fed began considering the timing for entering an interest rate cut cycle. The Taylor Rule, which adjusts the nominal neutral rate based on inflation and output gaps, provides a reference for the appropriate federal funds rate. In Q4 2024, the implied rate under the Taylor Rule was 4.05%, lower than the effective federal funds rate (EFFR) of 4.58% in November 2024. Furthermore, the Fed’s September 2024 meeting minutes revealed members’ rate expectations (see Figure 2), indicating a shift toward a rate-cut cycle, with a long-term average rate around 3%. Consequently, the Fed cut rates by 50 basis points in September and another 25 basis points in November, with further cuts expected in 2025.

|

Source: Federal Reserve Meeting Minutes (Nov. 2024)

Interest rate cuts have multiple implications for the machine tool industry. First, cuts aim to stimulate consumption and investment, boosting economic growth. On the consumption side, lower auto loan costs are expected to increase car sales, benefiting the automotive industry—a key downstream sector for machine tools. On the investment side, lower borrowing costs make it easier for companies to purchase equipment and increase capital expenditures, driving demand for machine tools across various applications. However, rate cuts also affect exchange rates. Taiwan’s central bank has implemented strict housing market controls, including consecutive hikes in reserve requirements and, in September 2024, the seventh round of selective credit controls—the most extensive and stringent to date. Therefore, Taiwan is unlikely to follow the Fed in cutting rates. As the U.S. continues to cut rates while Taiwan holds steady, the U.S. dollar weakens, and the New Taiwan dollar appreciates, hurting export competitiveness and causing foreign exchange losses that erode net profits. Overall, while a weaker dollar poses challenges, increased consumption and investment will likely boost manufacturing capital spending and machine tool orders, making Fed rate cuts a net positive for the industry.

Trump’s Return to Power

Donald Trump won the 2024 U.S. presidential election with 312 electoral votes. His policy agenda includes making personal income tax cuts permanent, reducing part of the corporate tax rate from 21% to 15%, deporting 11 million illegal immigrants, promoting oil and gas drilling, inducing dollar depreciation and intervening in monetary policy, and imposing tariffs of 10–20% on all imports (60% on Chinese goods). Among these, changes in tariffs and exchange rates have the most direct impact on Taiwan’s machine tool industry.

Trump’s proposal to impose a uniform 10% tariff (possibly 20%) on all imports and 60% on Chinese goods aims to protect U.S. manufacturing from low-cost imports. Although specific rates remain unclear, higher U.S. tariffs would severely disrupt the global economy, as targeted countries may retaliate, triggering a chain reaction. The IMF warns that a trade war could reduce global trade volume by 4% by 2026. Tariff hikes would raise U.S. import costs, causing imported inflation and undermining the Fed’s rate-cut policy, which could dampen U.S. manufacturing investment confidence.

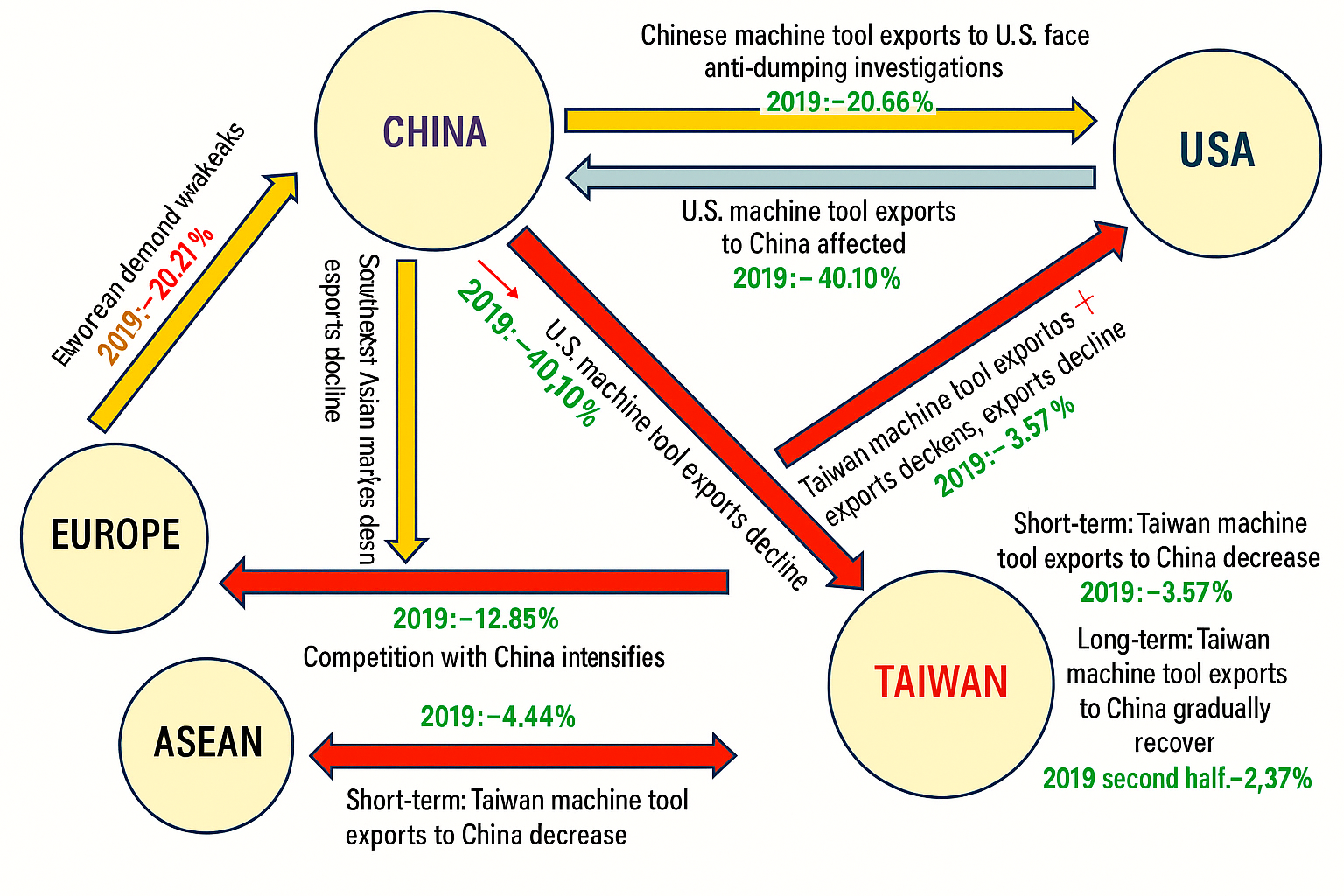

Trade wars and retaliatory measures would also hurt exports. During the 2019 U.S.-China trade war (see Figure 3), Chinese machine tool exports to the U.S. (HS Codes 8456–8463) fell 20.66% from 2018, while U.S. exports to China plunged 40.10%. Taiwan’s machine tool exports to the U.S. also declined as U.S. manufacturers adopted a cautious investment stance, despite some order-shifting benefits. Meanwhile, Chinese manufacturers expanded domestic sales and pursued import substitution, reducing demand for imported machine tools. Global firms relocated production out of China, further weakening Chinese import demand and hurting Taiwan’s exports to China, which fell 30.88% in 2019. Chinese firms also aggressively targeted ASEAN and European markets, intensifying competition for Taiwanese exporters.

If a new U.S.-China trade war erupts in 2025, history may repeat itself. This risk is heightened by China’s May 2024 suspension of tariff concessions under the Cross-Strait Economic Cooperation Framework Agreement (second batch), effective June 15. As a result, Taiwan’s machine tool exports to China (HS Codes 8456–8463) fell 26.84% year-on-year from July to October 2024.

|

Source: Customs Administration, Ministry of Finance (Taiwan); General Administration of Customs of China; U.S. Customs; Taiwan Institute of Economic Research Industrial Database (Nov. 2024)

On exchange rates, if U.S. tariffs on Chinese goods rise, Taiwan may benefit from order shifts, widening its trade surplus with the U.S. and making inclusion on the U.S. currency manipulation watch list routine. Combined with Fed rate cuts driving NT dollar appreciation, this would further hurt Taiwan’s machine tool exports.

Conclusion

With U.S. inflation under control, the Fed began rate cuts in September 2024, which could boost manufacturing investment confidence and equipment purchases. However, Trump’s election introduces significant uncertainty. Taiwan’s central bank governor Yang Chin-long recently warned that new U.S. trade policies could affect Taiwan’s economy and financial outlook through multiple channels. Higher tariffs and trade frictions would slow global growth and raise imported inflation, while supply chain shifts could increase production costs and global inflationary pressures. Additional tariffs on Chinese goods could spark a new trade war, weakening China’s economy—critical for Taiwan’s machine tool exports. China’s economic slowdown, import substitution, and suspension of tariff concessions will further hurt Taiwan’s sales in China.

Moreover, U.S. trade policies could raise inflation and slow growth, complicating Fed monetary policy. Nomura’s chief economist Jesper Koll recently noted that these changes could increase global capital flow volatility, destabilizing financial markets and dampening corporate investment confidence, leading to cautious equipment spending.

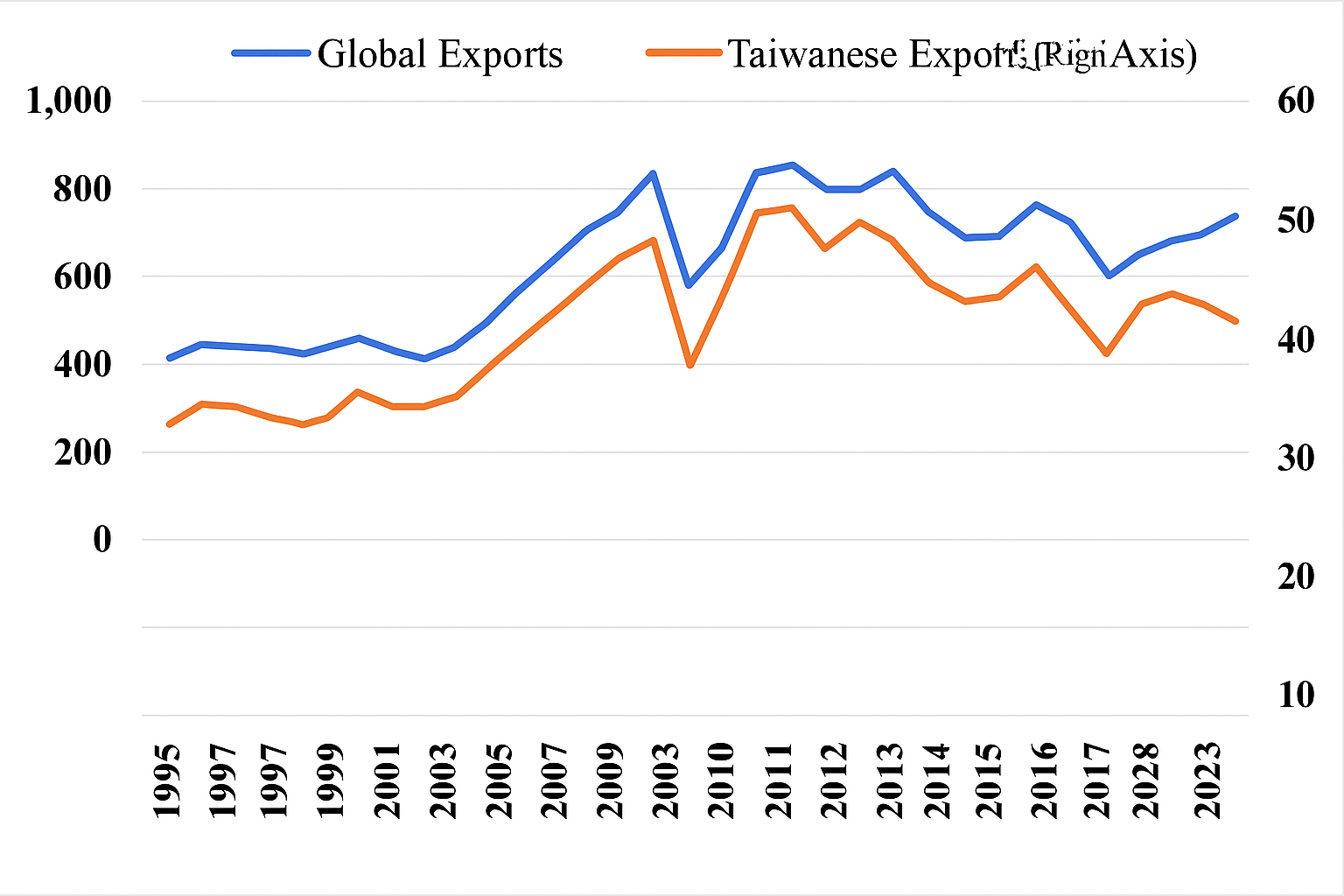

Overall, Taiwan’s machine tool export trends closely track global exports (correlation coefficient: 0.97; see Figure 4). However, while global exports grew in 2023, Taiwan’s declined due to yen, won, and euro depreciation eroding competitiveness and China’s import substitution. In 2024, Taiwan continued to face currency and Chinese policy headwinds, compounded by expanded export controls to Russia. After two years of declining output and exports, the industry’s low base means 2025 could see recovery driven by Fed rate cuts—if not for U.S. trade policy uncertainty. Still, Taiwanese firms can seize new opportunities in AI and ESG. The AI boom is creating new machine tool applications, with humanoid robots drawing attention. Leading firms such as Hiwin, TBI Motion, L&L Machinery, and Tongtai have secured projects with Apple and Nvidia. ESG trends are also accelerating equipment upgrades, offering Taiwanese firms a path to mitigate U.S.-China tensions and economic uncertainty.

|

Source: UNCTADstat; Taiwan Institute of Economic Research Industrial Database (Nov. 2024)