Impact Analysis of Mainland China’s Suspension of Early Harvest List for Certain Machine Tool Products

Background and Current Situation

1. Implementation of the ECFA Early Harvest List Benefited Taiwan’s Machine Tool Industry in the Mainland Market

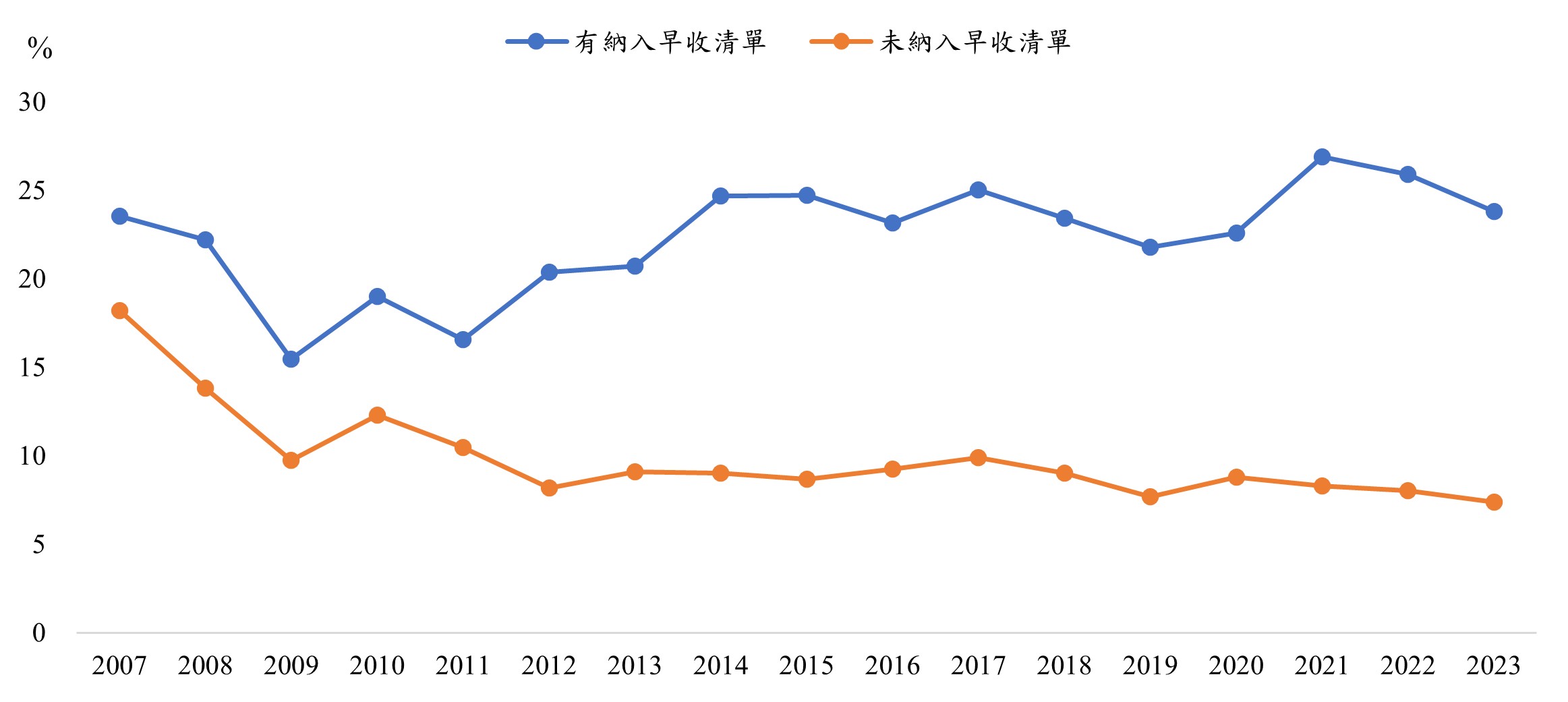

The ECFA Early Harvest List officially came into effect in 2011. Mainland China included 17 machine tool products in the tariff concession list, accounting for 13.6% of its total machine tool import items. Since China imposed relatively high tariffs to protect its domestic machine tool industry, the phased tariff reductions over three years significantly boosted Taiwan’s share of machine tool imports for products included in the list. Conversely, products not included in the list saw a decline in import share from Taiwan during 2011–2012 (see Figure 1), indicating that tariff concessions helped improve competitiveness in the Chinese market.

|

Source: Mainland China Customs, Taiwan Institute of Economic Research Industrial Economics Database (June 2024)

【Note】

- The proportion of products included in the Early Harvest List refers to the share of imports from Taiwan among Mainland China’s imports of products listed in the Early Harvest List.

- The proportion of products not included in the Early Harvest List refers to the share of imports from Taiwan among Mainland China’s imports of products not listed in the Early Harvest List.

2. Since 2011, China’s Import Substitution Policy Has Reduced Machine Tool Imports, but It Remains the World’s Largest Importer

China’s rapid economic growth since 2000 drove strong demand for machine tools, causing imports to surge. Although imports fell sharply in 2009 due to the global financial crisis, government stimulus measures and automotive policies revived demand, pushing China’s share of global machine tool imports to around 25% during 2010–2012. However, under the 12th Five-Year Plan (2011–2015), China aggressively promoted import substitution for machinery, leading to a decline in machine tool imports from 2013 onward. Despite this, China remains the world’s largest importer and a key battleground for global machine tool suppliers. Customs data show that from 2011 to 2018, China’s total machine tool imports had a CAGR of -4.39%, while imports from Taiwan fell at -4.44%. For products under the ECFA list, the decline was milder at -0.80%, compared to -6.16% for non-listed products, proving that tariff concessions cushioned the impact of import substitution and helped Taiwan maintain about a 10% share of China’s machine tool imports.

3. Mainland China’s Suspension of Tariff Concessions for Certain Machine Tool Products under ECFA Will Impact Taiwan’s Exports

After May 20, 2024, cross-strait tensions escalated, and China announced the suspension of tariff concessions for the second batch of ECFA-listed products. A total of 134 tariff items were affected, including four machine tool products . Except for “84589110 Vertical CNC Lathes for Metal Cutting” with a 5% tariff, the other three items face tariffs of 9.0% and 9.7%. Losing these concessions will significantly weaken competitiveness in the Chinese market.

From Taiwan’s export perspective, machine tool exports exceeded NT$100 billion before 2018. However, since 2019, factors such as the U.S.-China trade war, COVID-19, and aggressive U.S. interest rate hikes have dampened manufacturing investment and equipment spending. A sharp depreciation of the yen also hurt Taiwan’s exports. In 2023, exports fell to NT$78.7 billion, with shipments to China declining but still making China Taiwan’s largest export destination. Exports of ECFA-listed products to China rose to 85% of Taiwan’s China-bound machine tool exports in 2023 and reached 89.51% in Q1 2024. The four suspended items accounted for 43.26% of ECFA-listed exports to China and about 10% of Taiwan’s total machine tool exports, showing that China targeted Taiwan’s key products.

From China’s import perspective, strict COVID lockdowns and real estate crises weakened its economy, while import substitution policies further reduced machine tool imports. In Q1 2024, total imports fell 7.76%, but imports from Taiwan grew 13.9%, with ECFA-listed products surging 45.47%, thanks to zero tariffs. These products represented over half of Taiwan’s machine tool exports to China. With concessions removed, Taiwanese firms will face intensified competition from Japanese, Korean, and Chinese manufacturers.

Countermeasures

1. Increase Local Production in China and Expand to Other Markets

China remains Taiwan’s largest export market for machine tools, but shrinking demand due to supply chain shifts, slower growth, and import substitution poses challenges. The suspension of ECFA concessions worsens this outlook. Taiwanese firms should boost local production in China and actively explore alternative markets to offset lost orders. The U.S. reshoring trend and ASEAN’s rise as a manufacturing hub post-trade war offer opportunities. Foreign direct investment in ASEAN surged after COVID eased in 2021 , driving machinery demand. Taiwan’s investments in ASEAN have also grown significantly. Firms should target ASEAN markets, especially Taiwanese businesses there. Additionally, rapid EV development, EU’s 2035 ban on combustion vehicles, and U.S. IRA subsidies (up to $7,500 per EV) make Mexico a key EV investment hub, creating opportunities in North America and Europe.

2. Align with ESG Trends to Drive New Export Momentum

Extreme climate risks and global net-zero goals are reshaping manufacturing. The EU’s CBAM will take effect in 2026, and similar carbon border measures are emerging in the U.S., Japan, Mexico, and Canada. These will accelerate net-zero transitions. Machine tools generate significant CO₂ emissions during use, so procurement standards are shifting beyond precision, efficiency, reliability, cost-performance, and service to include carbon footprint during processing. Machine tool makers and component suppliers must adopt energy-saving and carbon-reduction measures, cutting power consumption and resource use during machining to help customers achieve low-carbon production. Embracing ESG trends will secure a strategic position in supply chains reorganizing for decarbonization and inject new momentum into export orders.