The Development of AI Robots and Taiwan's Competitiveness (Part II)

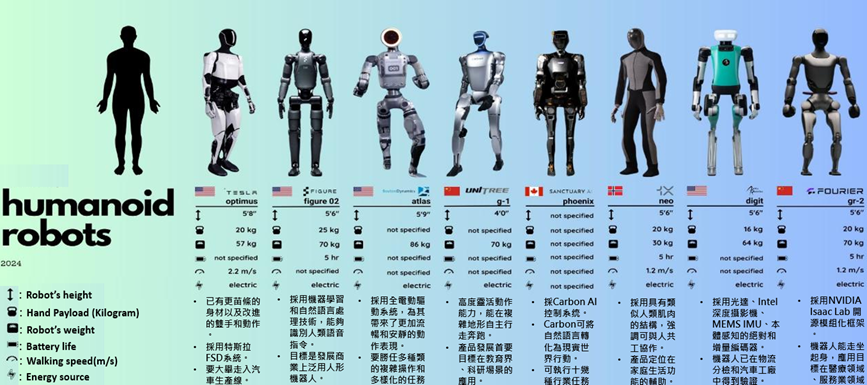

I. Overview of Major Global AI Robot Products

|

Source: sierracatalina1

Figure 1 provides an overview of the major AI Robot products worldwide. TESLA, Figure, Boston Dynamics, UNITREE, and Agility are highly scrutinized companies, and their products are all humanoid robots.

TESLA’s humanoid robot, Optimus, has continuously seen technical innovation since its public debut in August 2021, especially in its walking and object manipulation capabilities. By May 2023, the official website showed Optimus walking smoothly and grasping objects. By September, it was using machine vision technology to classify moving and non-moving objects and was fully trained end-to-end by neural networks, even performing actions like single-leg yoga poses. The Optimus Gen2, showcased in early December 2024, appeared capable of simulating the tactile pressure of human fingers, easily picking up fragile items like eggs. Optimus Gen2's hands have 11 degrees of freedom, and its walking speed is 30% faster than the previous generation, with its overall weight reduced by 10 kg. Its movement and manipulation capabilities are closer to human actions. It is expected that mass production of the Optimus robot is not far off, but reaching the stated goal of 100,000 units may require validated, real-world applications with actual performance. With continuous technological progress and gradual production capacity increases, the upgrades and validation progress of the Optimus humanoid robot will remain a global focus, serving as a key indicator of success or failure for humanoid robots in this wave of development.

Next is Figure, a company that successfully developed the highly technical Figure series humanoid robot within just one year and publicly demonstrated its dynamic bipedal walking ability. Figure 01 entered practical training at a BMW US factory in February 2024, and the integration of OpenAI's ChatGPT into Figure 01 was announced. Based on end-to-end motion control algorithms combined with OpenAI’s GPT, the robot publicly demonstrated high autonomy and intelligent interaction without pre-set programming, ahead of TESLA.

Boston Dynamics was founded in 1992 as an academic laboratory, funded by the US military, and went through three changes in ownership, being acquired successively by Google (US), SoftBank (Japan), and Hyundai Motor (South Korea). Its military and defense development background established its characteristic of being less cost-sensitive. The robots use hydraulic drives and 3D printing technology for parts, resulting in high costs and slow commercialization. However, the human-robot collaboration scenarios demonstrated by its Atlas humanoid robot on construction sites have generated immense global interest among robot enthusiasts, making it impossible to ignore its future developments.

UNITREE (Yushu Technology), established in August 2016, focuses on the R&D, production, and sales of consumer-grade and industrial-grade high-performance quadruped robots and dexterous six-axis robotic arms. Its humanoid robot, H1, is expected to be priced within a few hundred thousand RMB, with the ambition of becoming the DJI of ground-based robotics at a competitive price.

Agility, founded in 2015 and headquartered in the US, is a robotics spin-off from Oregon State University. It has now opened RoboFab, a robot manufacturing facility in Salem, Oregon. It primarily develops bipedal robots for logistics and inspection applications. Their robot product, Digit, has a proven track record in warehouse tasks such as unloading trucks, moving boxes, and managing shelves. Damion Shelton, co-founder and CEO of Agility Robotics, stated, "We built Digit to solve the tough problems in today’s workforce: injury, burnout, high turnover, and unfilled labor gaps. The ultimate vision is to make humanity more human. When you’re developing new technology to make society better, the most important milestone is when you can produce that technology at scale so it can have a real, widespread impact."

Agility currently has the capacity to produce several hundred Digit robots per year and claims the ability to scale up to 10,000 robots annually in the future. To accelerate robot application, the company has removed non-essential structures and functions from the robot, prioritizing functionality to retain only the most streamlined, core structural parts. For instance, the robot’s end effector uses grippers rather than five-fingered hands, based on their assertion that "highly human-like robotic hands are very complicated." Agility has partnered with companies like Amazon and Ford. Digit is being tested in Amazon's facilities for logistics handling and is being applied in logistics tasks at GXO Global Logistics. Agility is considered highly likely to become the first company globally to achieve commercial mass production of humanoid robots.

From the current product development of major global AI Robots, we can summarize several key trends:

1.US Technology Companies, with their advantages in computing power and large models, are poised to lead humanoid robot development.

TESLA is in a leading position in robot advancement, self-developing and self-producing everything from chips, data training, and large models to the physical robot body and motion control models. They have already announced a mass production target of thousands of units for 2025. Furthermore, NVIDIA, well-known for its powerful computing capabilities and data training platform advantages, has used its chips, data, large models, and development platforms to build the underlying development ecosystem for humanoid robot companies. NVIDIA currently cooperates with at least 14 humanoid robot companies. Google is next, having shifted from focusing on the physical robot to concentrating on the robot large model, and now partnering again with robot companies for next-generation humanoid robots. Google also possesses large model capabilities. OpenAI is currently involved in small-scale R&D of the robot body through investment and its own efforts. Additionally, Apple and Meta are involved; Apple is currently focusing on specialized perception in robotics, launching the ARMOR robot sensing system usable for robotic arms, and Meta has acquired the Digit haptic sensor team.

2.US-led startups and technology companies are strengthening large model collaborations to accelerate commercial application.

Figure's Figure 02 robot has already received orders from BMW and Amazon. The company anticipates a demand for 100,000 units from these two major clients over the next four years, with a sales target of several thousand units in 2025. Figure has received investments from many tech giants and has a strong shareholder background. Agility focuses on logistics scenarios, having secured orders from Amazon and GXO, and is the fastest in scaling up commercialization, currently building capacity for 10,000 robots. 1X focuses on home scenarios, targeting a production of 1,000 units in 2025. Apptronik plans for commercial mass production by the end of 2025 and has collaborated with Google on next-generation robots. Germany's Neura Robotics had €1 billion in orders on hand by January 2025. We observe that all these companies have joined NVIDIA's Cosmos, leveraging large models to accelerate iteration.

3.Robot Companies Emphasize Practical Applications, with 2025 as the First Year of Humanoid Robot Mass Production.

The vast majority of companies are first deploying in automotive production lines and logistics scenarios. Some companies, such as 1X and Neura Robotics, also prioritize home application scenarios, with varied forms of bipedalism and hands. The 2025 goals for each company range from a few hundred to several thousand units, and the total output from these robot companies is expected to exceed 10,000 units in 2025. With large-scale mass production, the supply chain will likely shift to Asian providers, with Tier 1 suppliers tied to Tesla as a primary target.

The primary development trend for humanoid robots is their ability to achieve smoother, faster movement and hand grasping. Although current humanoid robots, like humans, possess interconnected hand and foot hardware, they still lack the innate flexibility of humans, sometimes appearing clunkier than expected. Humans are born with this end-to-end capability, while robots are not. Therefore, the technology for robot sensors and limb haptics remains a key area of pursuit for many companies, including LiDAR technology to judge the distance between the robot and other objects while walking, or material technologies like piezoelectric components and Shape Memory Alloys (SMAs). The reason humans can perform precise movements is the richness of the body's sensory neural networks, which provide sensory signals to the brain to achieve accurate control.

One reason for robot development is the labor shortage. Another main reason is the AI technology that serves as the robot's brain. With continuous application breakthroughs in GAI, AI is expected to enable robots to perform complex movements and recognition tasks, accelerating the popularization of humanoid robots. The humanoid robot is one of the best vehicles for realizing AI technology. However, a key challenge lies in the cost of the robot's technical realization versus the application scenarios.

A debated technical point is: Must the external form resemble a human? Wheel-based Autonomous Mobile Robots (AMRs) for material transport have far greater mobility efficiency and flexibility than bipedal walking robots. So why are so many companies investing in humanoid robot products today?

Robotic arms have their usage limitations. We observe the development of robots from industrial to enterprise use, evolving from robotic arms, to robotic arms mounted on AGVs, to AMRs driven by tracks or omnidirectional wheels. All of these can only operate on a single flat plane. If robots are to perform applications such as education, entertainment, caregiving, companionship, reception, guided tours, exploration, or disaster relief, human-robot collaboration is unavoidable. Factory robotic arms have limitations in these applications. Therefore, humanoid robots, compared to robotic arms, exhibit intelligent functions outside of industrial applications that resemble human-robot collaboration, are more amicable in interaction, and can flexibly switch between different tasks quickly. Because the humanoid robot's shape is similar to humans, it is expected to better adapt to human social environments and flexibly switch between different tasks. Since its way of understanding and interacting with the world is similar to humans, the humanoid robot has been viewed as the worker of the AI era and the human companion of the AI era.

Smoother walking and gripping, smarter sensing technology (voice and visual recognition), the problem of labor shortages, and breakthroughs brought by AI technology are the key focus areas and reasons for the development of humanoid robots today. We observe that the global companies mentioned above, which are primarily invested in humanoid robots, all seem to focus on the stability of the robot's leg movements and the dexterity of its hands. We see Boston Dynamics' ATLAS robot performing complex movements like backflips and dancing. The news that a football team composed of humanoid robots is scheduled to compete against a human football team in the RoboCup (Robot World Cup) in 2050, with the robot team expected to win, sparks our imagination, allowing us to visualize scenarios where robots and humans are kicking and shooting goals against each other.

II. Opportunities for Taiwan

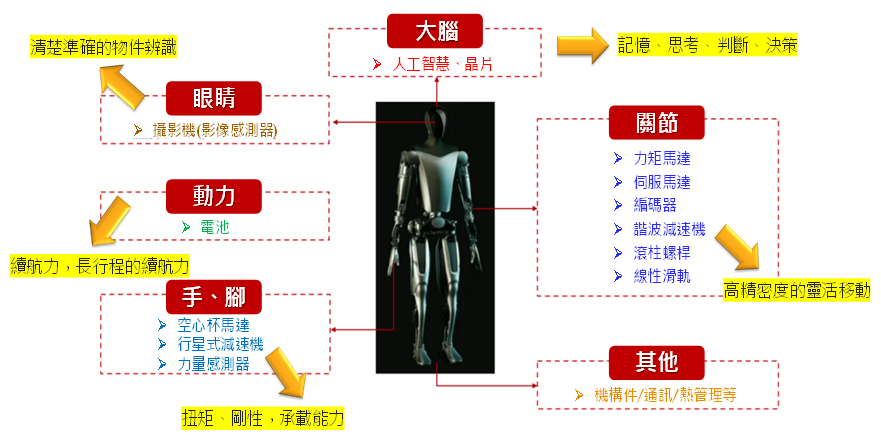

Figure 2 illustrates the performance exhibited by various structures of the humanoid robot. Before discussing the opportunities for Taiwan’s related industries in the current booming global development of humanoid robots, we first identify the primary technical challenges: 1. Autonomous movement, 2. Recognition and identification, 3. Precision control, and 4. Communication.

Figure 3 lists the technical developments for humanoid robots, including robot cognitive technology (using chips, sensors, and algorithms to mimic human perception), high-precision control technology, robot autonomous movement, and robot communication technology. This is where we see opportunities for Taiwan's industry, including: 1. Taiwan’s complete IC manufacturing ecosystem and advanced chip process technology; 2. A comprehensive robot component supply chain; and 3. Extensive system integration experience with ICT products.

Figure 2: Performance Exhibited by Various Structures of the Humanoid Robot

Source: ITRI International Strategy Development Center

With a potential market size of tens of billions of US dollars annually for humanoid robots, Taiwan can offer integrated solutions with high added-value functionality in applications and penetrate the supply chains of US and European manufacturers with key component products. This means leveraging Taiwan’s complete IC manufacturing ecosystem and advanced chip process technology, its comprehensive robot component supply chain, and its extensive system integration experience with ICT products.

First is Taiwan's complete IC manufacturing ecosystem and AI chip process technology, including the development of advanced chips, especially processes $7\text{nm}$ and below. Relevant companies will also have significant energy in innovative chip development using advanced heterogeneous integration and packaging technologies (such as chiplet integration packaging modules, silicon photonics, etc.) and innovative chip development using heterogeneous integration micro-electromechanical sensing technology, with wafer-level processes $0.35\mu\text{m}$ and below. These are necessary to empower smart robot functions such as artificial intelligence, high-performance computing, high-performance inference, and high-performance communication.

Figure 3: Technical Development of Humanoid Robots

Source: TESLA, ITRI International Strategy Development Center

Taiwan already possesses a supply chain for humanoid robot components. Companies have the capability to develop "key components for recognition technology and drive control systems," which are crucial for the robot's "eyes" (sensors) and the agility of its hands and feet.

Like humans, the main actuating mechanisms of a humanoid robot are its joints, which consist of the control system, servo system (driver, servo motor, encoder), and reducer. These three components are estimated to account for nearly 70% of the cost.

The joints of a humanoid robot must satisfy several characteristics:

-

High Efficiency: Humanoid robots driven by DC batteries prioritize battery life. To achieve long-duration operation, the transmission and motion mechanisms must have excellent transmission efficiency.

-

Lightweight: The weight requirement for humanoid robots is extremely strict because they have not just a few joints, but dozens or even hundreds. Weight is crucial for the robot joint, which is why we see some robot skeletons shifting from magnesium alloy to carbon fiber composite materials.

-

Modularity: This is required for ease of replacement in the robot's hands or feet and for interoperability among different robots, which involves practical mass production technology.

-

High Torque and High Rigidity: Humanoid robots will inevitably encounter contact and collisions in their application scenarios, so their load capacity must be high, and they must have a certain overload capacity. Therefore, components used, such as couplings, timing belts, gears, DC servo motors, reducers, and planetary roller screws, must have certain torque and rigidity.

-

Cost-Competitive Mass Production Technology: This relates to the hard demand for on-the-ground applications.

Furthermore, Taiwan has accumulated extensive system integration experience in ICT products over many years. If the global market size for humanoid robots reaches millions of units annually in the future, many Taiwanese manufacturers with ICT technology integration capabilities absolutely have the capacity for mass-producing robot products.

Since the advent of Generative AI, people have truly noticed its multi-modal technology that can accept text, voice, images, or data. As more parameters are added to the model, it can handle more complex tasks, leading to greater imagination for the future development of smart robots.

Compared to edge devices like smartphones and personal computers, humanoid robots require a multi-modal large model that combines language, vision, and action. Moving from single-modal to multi-modal models is expected to achieve a better "brain." Currently, mainstream embodied intelligence large models commonly use VLM (Vision Language Model) as the backbone, performing the task of "Task Planning," the so-called brain.

The human brain is primarily composed of the cerebrum and cerebellum. The cerebrum's main functions are memory, thinking, judgment, decision-making, and problem-solving. The cerebellum is mainly responsible for controlling body movement coordination and balance. The current closed-source models force many embodied intelligence teams to develop both the brain and cerebellum from scratch. Overall, due to the lack of training data, the brain's "Task Planning" ability is relatively mature, while the cerebellum's "Motion Planning" is weaker. The recently highly-regarded language large model, DeepSeek-R1, with its open-source strategy, is expected to lower the industrial barrier at the brain level and promote more focus on the underlying motion control.

The humanoid robot's cerebellum is primarily managed by mechanical components. We observe that the cerebellum is already an area of expertise for many robot companies, with increasing confidence in the mechatronic control of its actuation. In the actuation of humanoid robot joints, many technical indicators pursued differ significantly from industrial robots, such as control technology and drive technology. Furthermore, the humanoid robot's arm does not require the same level of precision, high speed, and large load capacity as an industrial robot, but it must possess safety, high torque density, and impact resistance. These demands bring design challenges in motor selection and transmission methods, including lightweight structure development technology, dynamic environment adaptation technology, and composite thin-profile motor power coupling technology.

Conclusion

Humanoid robots are a more complex system than industrial robots and are more difficult to manufacture. If the robot's hardware itself continues to be optimized, such as in: 1. Functional realization of high-complexity dexterous hands; 2. Mass production and cost reduction of roller screws; 3. Perfection of the harmonic reducer industry chain; 4. Force sensor technology; and 5. Robot vision and motion capture technology, these are all areas where Taiwanese companies have existing capabilities. Coupled with real-world application scenarios that meet genuine demand, humanoid robots can achieve industrialization. From the perspective of the humanoid robot mass production timeline, 2025 will be a breakthrough year. Mass production at the 10,000-unit level will drive the downstream industry chain into the product mass production stage, and data acquisition and training at the 10,000-unit level are expected to truly solve the problem of data scarcity, pushing humanoid robots toward a more versatile and practical phase.