Current Cases, Layout Suggestions, and Future Prospects of Machine Tool Applications in the Semiconductor Industry

Expanding Business Opportunities and Creating Win-Win Outcomes

In recent years, Taiwan’s machine tool industry has faced severe challenges. On one hand, the performance and specifications of Chinese machine tools have been improving rapidly, creating strong competitive pressure on Taiwanese products. On the other hand, Japanese machine tools have gained a significant price advantage due to yen depreciation, causing many orders to shift to Japan. Facing the aggressive Chinese market and the need to catch up with Japan, domestic machine tool manufacturers must actively explore new application fields to break through.

The semiconductor industry, as one of the most prominent global sectors, offers Taiwan a complete and robust supply chain. If domestic machine tool manufacturers can reduce reliance on foreign equipment suppliers, they will have the opportunity to leverage this trend, break free from traditional market frameworks, and create maximum synergy and market value alongside the fast-growing semiconductor industry.

This article first compiles domestic and international case studies to analyze the current status and trends of machine tool applications in semiconductor processes and equipment. It then provides strategic recommendations for Taiwanese machine tool manufacturers t]o enter the semiconductor industry and outlines future prospects. Through these analyses and suggestions, we aim to open new development paths for Taiwan’s machine tool industry and achieve industrial upgrading and transformation.

International Cases of Machine Tool Applications in Semiconductor Processes/Equipment

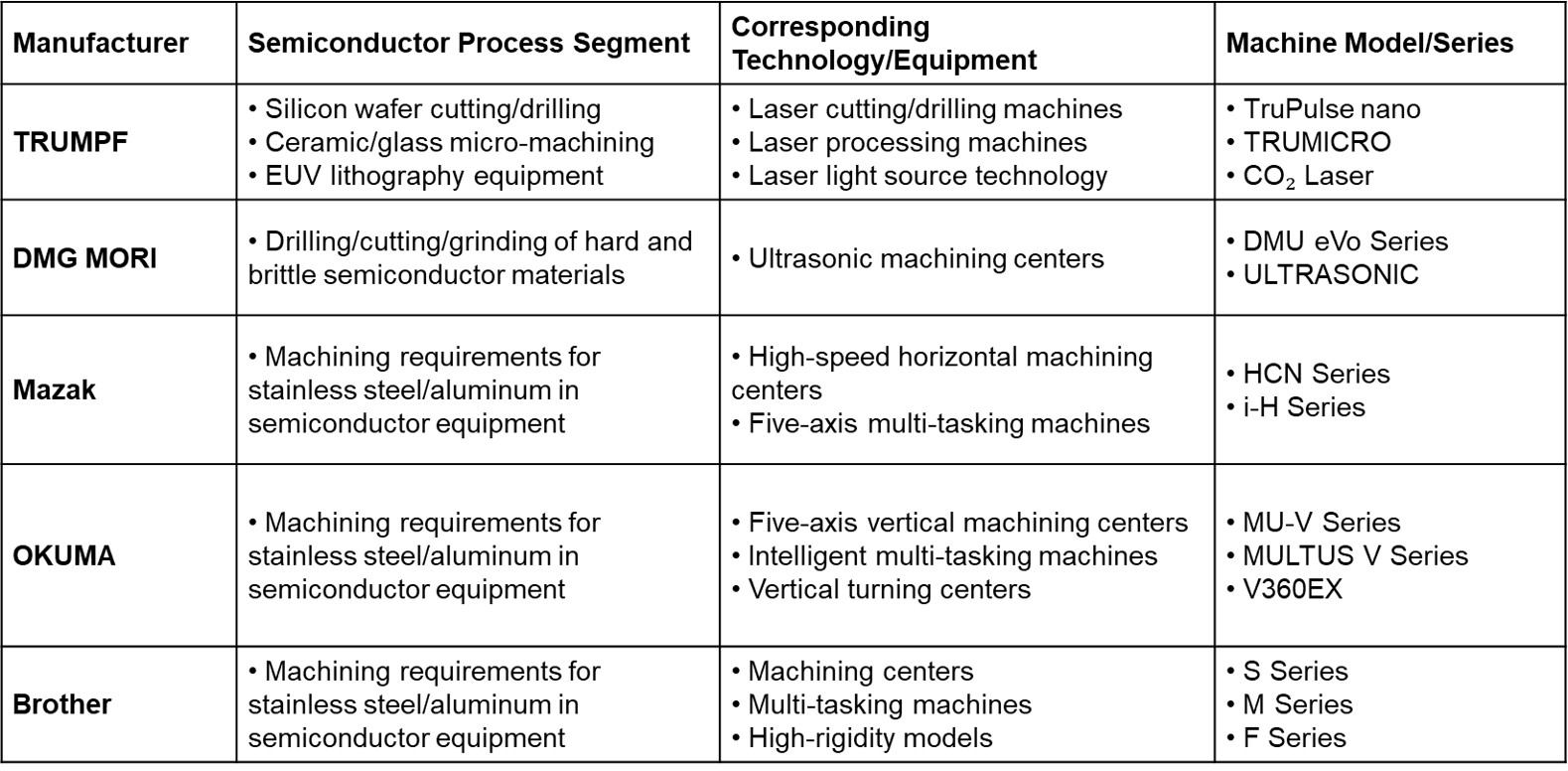

Globally, German and Japanese manufacturers have the most comprehensive layouts and complete product lines in applying machine tools to the semiconductor industry. Below is an analysis of these companies:

-

Germany’s TRUMPF plays a foundational role in advancing semiconductor technology, primarily due to its world-leading laser technology. Lasers are critical in semiconductor applications such as silicon wafer cutting and drilling, micro-machining of ceramics and glass, and marking electronic components. In front-end semiconductor processes, EUV lithography equipment relies heavily on laser light source technology. ASML, a major lithography equipment manufacturer, has long maintained close cooperation with TRUMPF. Experts predict that ASML’s lithography machines will remain unmatched by competitors like Nikon and Canon for the next decade.

-

Japan’s DMG MORI has long specialized in machining hard and brittle materials, launching equipment such as the eVo series and gantry-type machine tools suitable for various workpiece sizes. Its ultrasonic machining technology enables efficient drilling, cutting, and grinding of materials like quartz, silicon carbide, and ceramics, extending tool life. Applications include gas diffusion plates for CVD processes, quartz rings for coating, and wafer handling chucks.

-

Mazak excels in developing multifunctional machine tools and process integration. For example, its five-axis composite machine tools can simultaneously process stainless steel and aluminum—materials commonly used in semiconductor equipment such as vacuum chambers and transmission components. Mazak also offers energy-saving, automated, and unmanned factory solutions.

-

Okuma provides advanced equipment lines such as five-axis machining centers, intelligent composite machines, and vertical lathes to meet high-precision and high-surface-quality requirements for semiconductor equipment components like chambers, screws, and covers.

-

Brother offers diverse machine tools for manufacturing semiconductor equipment components, including processing centers, composite machines, and high-rigidity models across its S, M, and F series.

|

Source:DMG MORI

|

Source:Mazak

|

Source:Okuma

|

Source:Brother

|

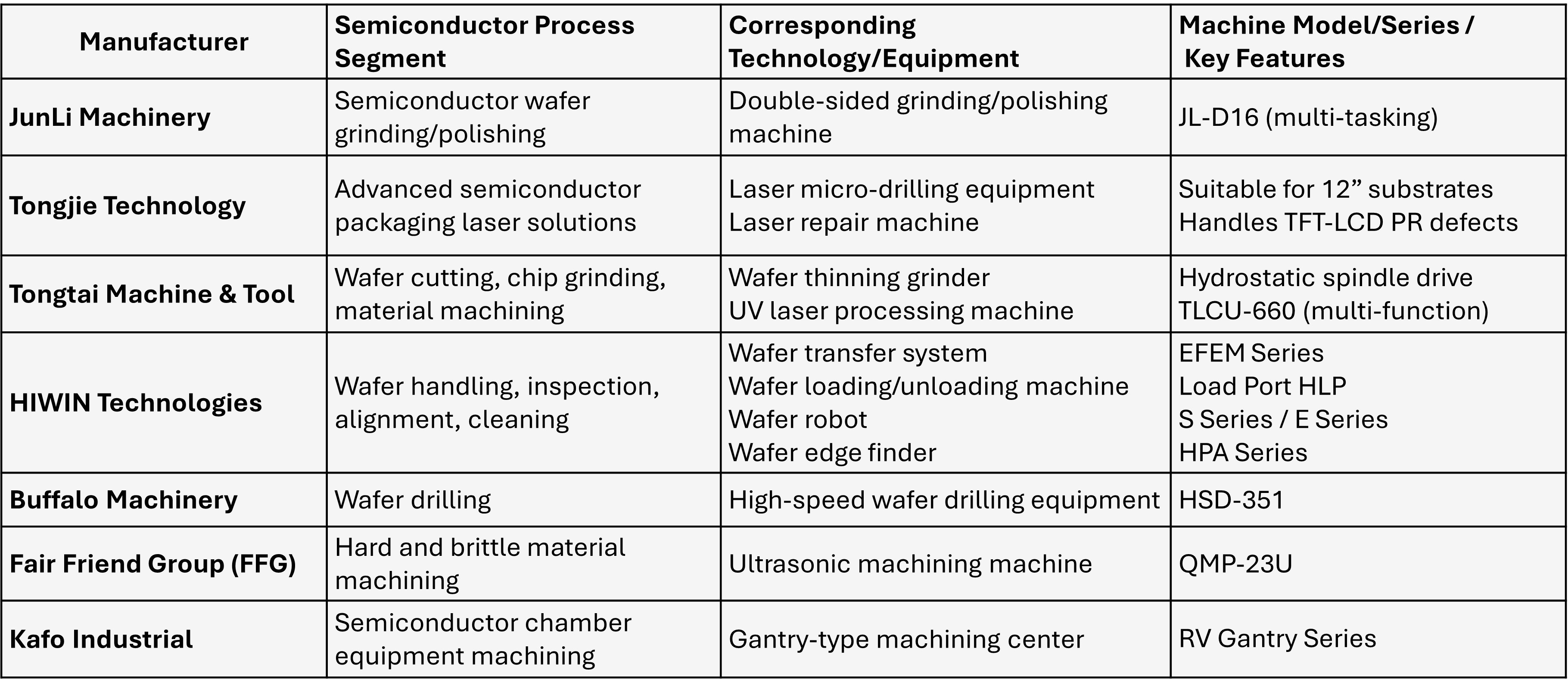

Domestic Cases of Machine Tool Applications in Semiconductor Processes/Equipment

-

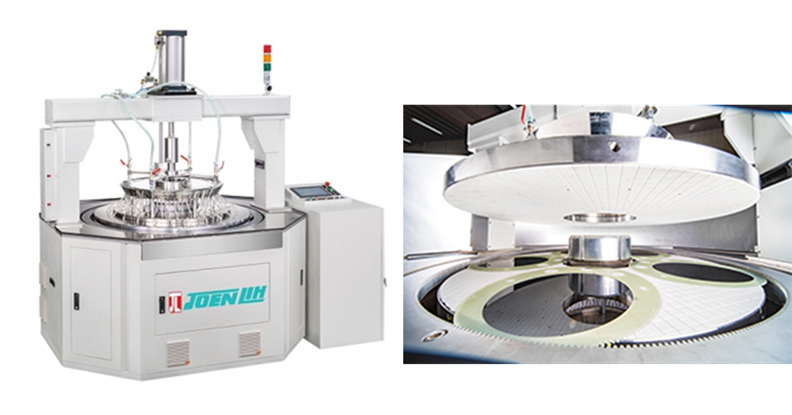

JunLi Machinery was the first domestic company to enter the semiconductor grinding field, specializing in precision grinders. It developed the JL-D16 double-sided polishing and grinding machine for semiconductor needs, capable of handling warped materials and performing multi-piece grinding to improve efficiency and reduce costs.

-

G2C+ Strategic Alliance (CSUN, GPM, GMM, TCF, UTRON, VM) collaborates to provide localized equipment for advanced packaging processes, including plasma cleaning, wafer inspection automation, and high-precision die bonding.

-

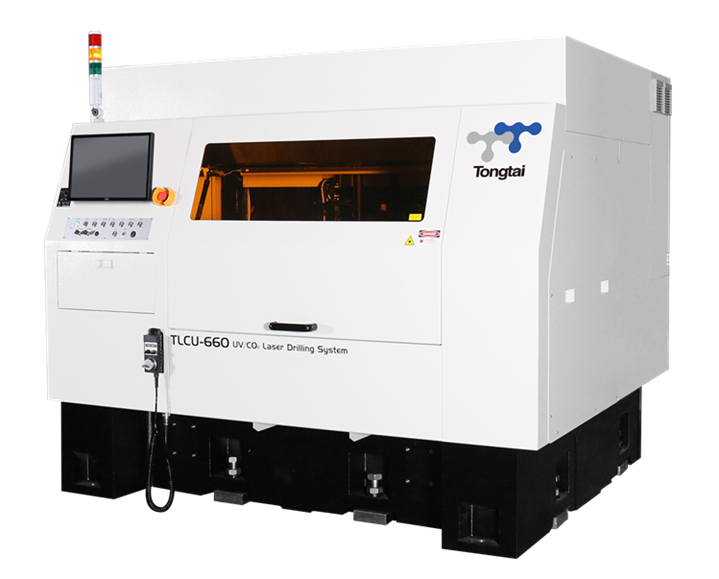

Tongtai Machine & Technology offers laser cutting and repair solutions for IC chips and wafer grinding systems suitable for small-batch production with high stability and precision.

-

HIWIN Technologies focuses on transmission components and semiconductor subsystems such as wafer handling robots and alignment systems, expanding into Korea and Japan markets.

-

Buffalo Machinery leveraged its acquisition of UK-based Winbro to enter semiconductor drilling and laser machining, serving major U.S. semiconductor clients.

-

Fair Friend Group (FFG) developed ultrasonic machining tools for hard and brittle materials like ceramics and quartz, targeting U.S. semiconductor supply chains.

-

Kafo transitioned from large-scale machining equipment to high-precision, compact machines, aiming to penetrate semiconductor component manufacturing through acquisitions and partnerships.

-

Figure 5. JunLi’s Double-Sided Grinding/Polishing Machine for Semiconductor Wafer Processing

Source: JOEN LIH MACHINERY

-

-

Figure 6: Contrel ’s Laser Repair and Micro-Drilling Equipment for Semiconductor Applications

Source: Contrel Technology

|

Source: Tongtai

|

Source: Hiwin

|

Source: FFG

|

Source:Kafo

|

Strategic Recommendations and Future Prospects

Layout Suggestions:

- Technology R&D and Innovation: Invest in new technologies to enhance precision and efficiency for semiconductor processes.

- Industry Chain Integration: Collaborate with supply chain partners to strengthen competitiveness.

- International Market Expansion: Target major semiconductor markets such as the U.S. and China.

- Talent Development: Train professionals to meet the fast-changing semiconductor industry demands.

- Policy Support: Advocate for government R&D subsidies and establish testing fields for machine tool applications in semiconductor processes.

Future Outlook:

By collaborating with Taiwan’s semiconductor supply chain, domestic machine tool manufacturers can become key global suppliers of semiconductor equipment, elevating Taiwan’s position in the global semiconductor industry. This will also drive local industrial development, create jobs, and generate economic benefits. However, achieving this vision requires long-term investment, patience, and determination.