Overview of the Machine Tool Industry in Central Europe

Central Europe primarily consists of eight countries: Austria, the Czech Republic, Germany, Hungary, Liechtenstein, Poland, Slovakia, and Switzerland. With a total population exceeding 160 million, the region is dominated by Germanic and West Slavic ethnic groups, with German as the primary language. Geographically, it serves as the transportation hub of the European continent. Due to its central location, it exhibits diversity in its natural conditions and shared characteristics in politics, economy, and culture. Most Central European nations are high-income economies. While their economic levels are generally lower than Northern and Western Europe, they surpass Eastern Europe. Germany, Switzerland, Austria, and Liechtenstein are highly developed, with Germany serving as the economic representative. Europe's industrial center of gravity is rooted in southern Germany and extends into Poland, the Czech Republic, Slovakia, and Hungary. These countries not only provide OEM raw materials and components for Germany but also possess autonomous assembly and manufacturing capabilities for automotive and industrial equipment. As the automotive industry is the primary application for machine tools (accounting for approximately 45%), Central Europe is the stronghold for machine tool production and application.

Current Status and Statistics of the Central European Machine Tool Market

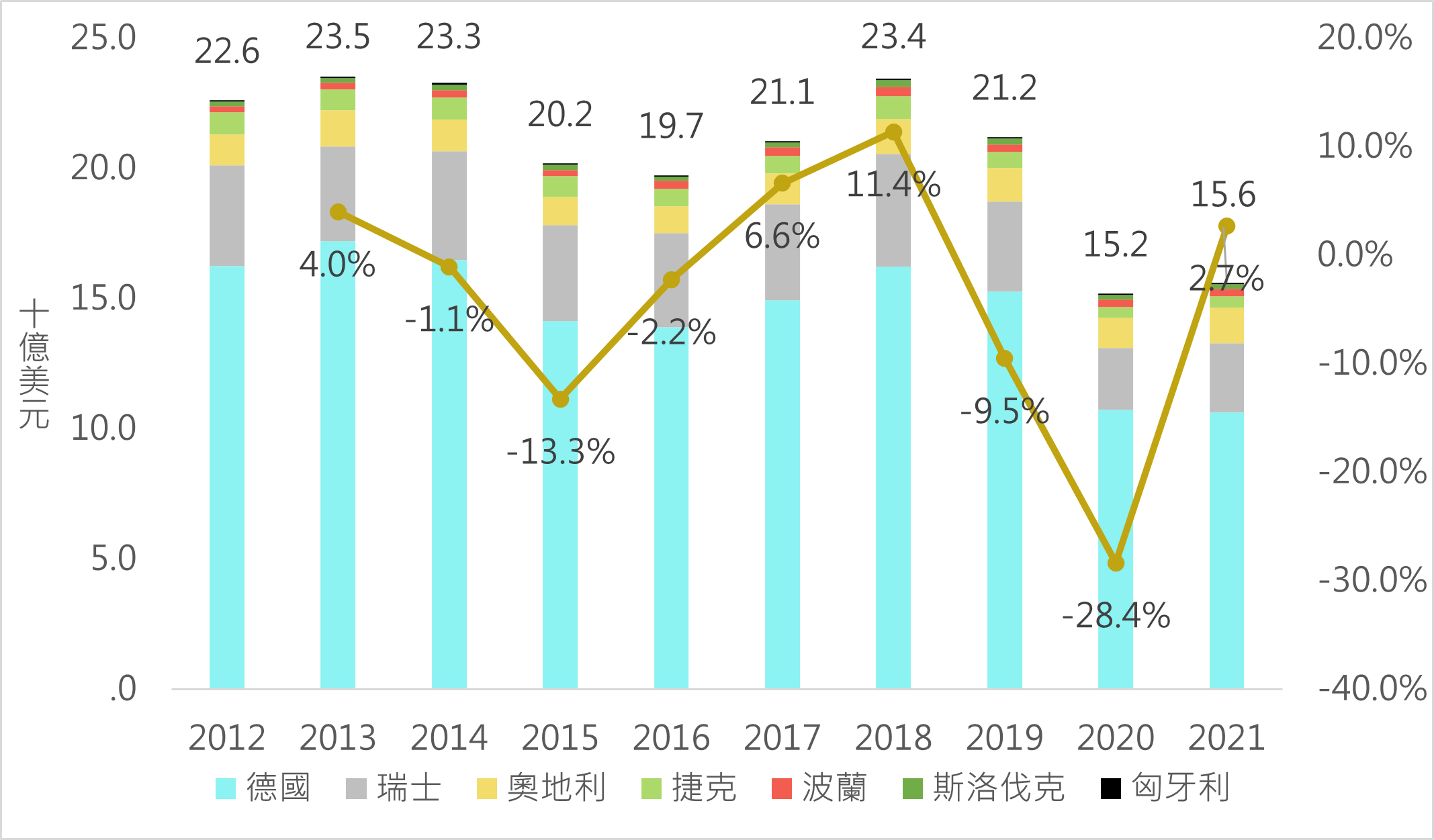

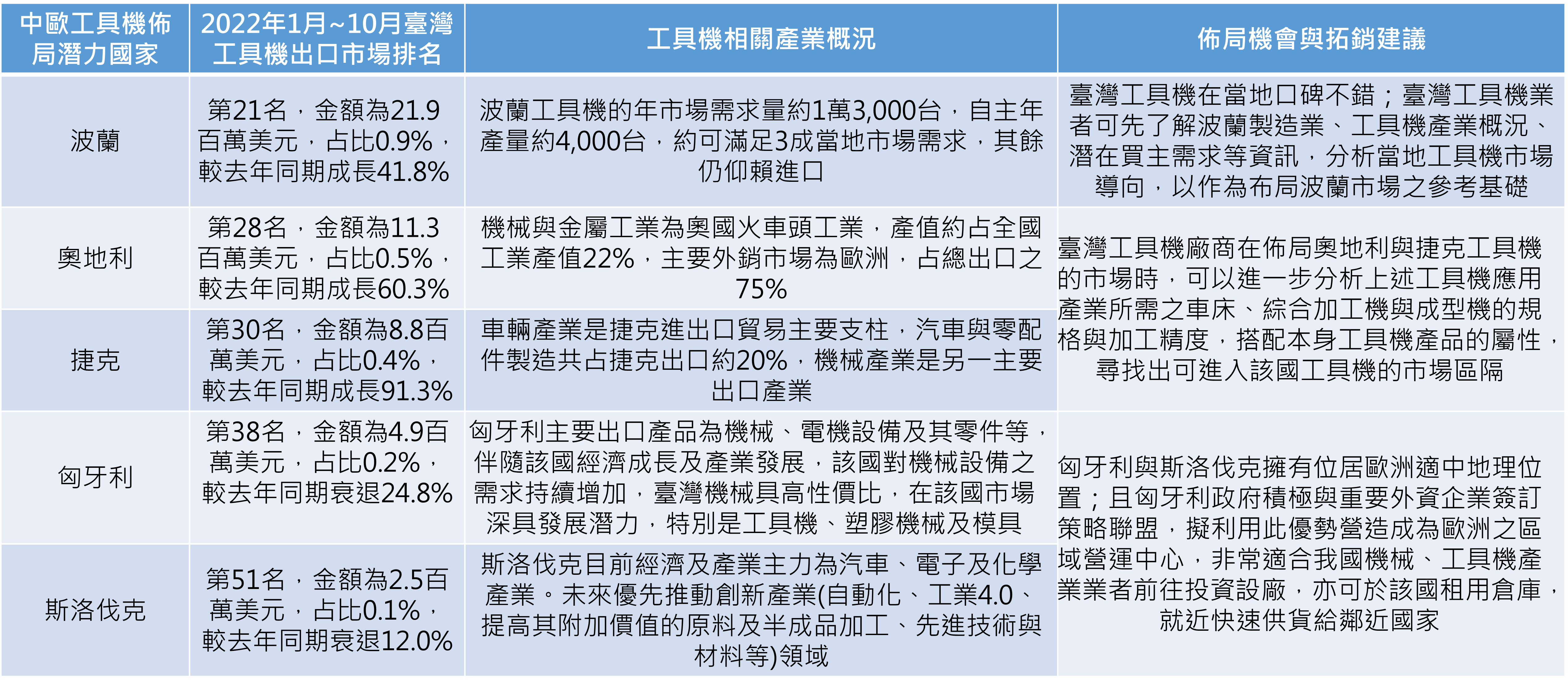

This analysis focuses on seven major countries—Austria, the Czech Republic, Germany, Hungary, Poland, Slovakia, and Switzerland—as data for Liechtenstein is minimal. Over the past decade (2012–2021), the production value of machine tools in these countries reached $15.6 billion in 2021, with a 10-year CAGR of -4.0%. Since 2020, Europe has been a primary victim of the pandemic, the Russia-Ukraine war, energy crises, and global inflation, impacting both manufacturers and the upstream machine tool industry. Furthermore, as Asian countries like China, Taiwan, Japan, and South Korea offer more attractive labor and production costs for comparable products, foreign investment has hesitated due to market recession and environmental regulations. However, since the hardware gap with Asia is narrowing, Central Europe has invested heavily in software development to enhance competitiveness. With Germany pioneering "Industry 4.0" and the region benefiting from low language barriers and ease of movement, these nations hold an advantage in recruiting IT talent compared to Asian competitors.

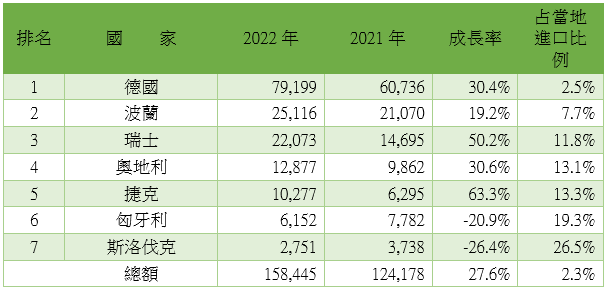

According to the Gardner Intelligence database, Taiwan's machine tool exports to Central Europe reached $160 million in 2022, a 27.6% increase from 2021. The top three growth markets were the Czech Republic (63.3%), Switzerland (50.2%), and Austria (30.6%). Taiwan's share in each import market is as follows: Germany (2.5%), Switzerland (11.8%), Austria (13.1%), Hungary (19.3%), Poland (7.7%), the Czech Republic (13.3%), and Slovakia (26.5%).

|

|

Dynamics of Application Industries

The industrial foundations of Germany, Switzerland, and others are rooted in automotive, machinery, aerospace, and electronics.

-

Automotive Industry: Central Europe is a vital production base. Germany hosts global leaders, while the Czech Republic, Hungary, and Poland are major producers of vehicles and parts due to skilled labor and location.

-

Electric Vehicles (EVs): In 2022, Germany became Europe's largest EV market, with EVs accounting for 25% of new car production. In Poland, EV registrations grew by 69% in 2022.

-

Regional Specialties: The Czech Republic's Škoda is a global brand; the country's manufacturing is highly dependent on Germany (30% of GDP). Slovakia remains the world leader in per capita car production (249 cars per 1,000 people). Hungary, the "Detroit of Europe," hosts 14 of the world's top 20 automakers, including a massive new battery plant by CATL.

Dynamics of Leading Machine Tool Manufacturers

-

Germany: The benchmark for high-end tools, leading in digitalization, lasers, and 3D printing.

-

Switzerland: Focuses on ultra-precision micro-machining for medical, aerospace, and luxury watches.

-

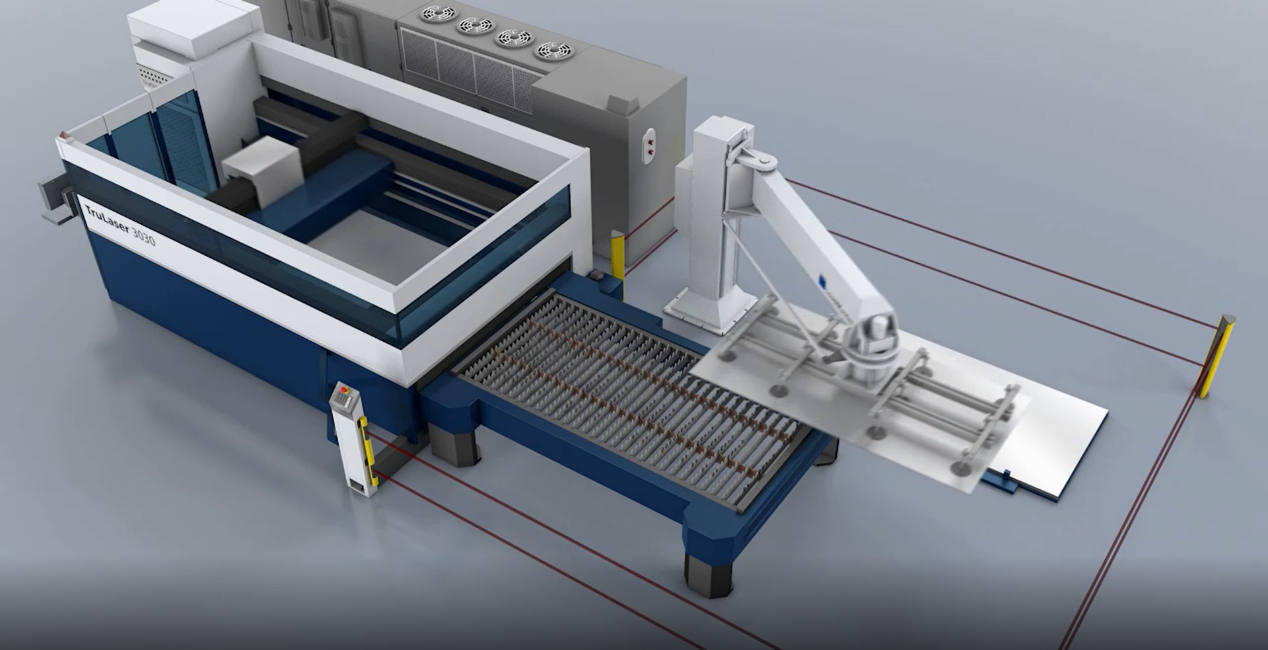

Schuler AG: Active in China and specializes in specialized presses and lathes. Their LoadMaster System integrates robotics and smart warehousing for automated loading/unloading.

-

Figure 2: LoadMaster System Automated Loading and Unloading Solution

-

TRUMPF Group: A top-three global player. Their IIoT platform, TruConnect, enables monitoring of both new and legacy machines, integrating with Microsoft Azure and Siemens MindSphere for Digital Twin applications.

-

Figure 3: (a) Integrating legacy TRUMPF machines into the system via the OPC UA Retrofit Cube; (b) Integrating third-party and legacy TRUMPF machines into the system using the Basic Connectivity Kit.

-

GF (Georg Fischer AG): Known for 5-axis centers and laser machining for high-tech materials. Notably, they also manufacture lightweight die-cast parts for EVs (e.g., Fisker), reducing weight by 50% compared to steel.

-

Figure 4: GF Aluminum Die-Casting Solution Significantly Reduces Product Weight and Enhances Scrap Recycling Rates

Future Trends and Layout Opportunities

The EU's "Factories of the Future" and "Made in Europe" (under Horizon Europe 2021–2027) initiatives aim to assist SMEs in transitioning to green, digital, and resilient manufacturing using AI, 3D printing, and robotics.

|

Taiwanese electronics giants are already expanding in the region: Acer (Czech Republic), Compal (Poland), Foxconn (Hungary, Czech Republic, Slovakia), and Wistron/Pegatron/Inventec (Czech Republic). This cluster effect, combined with the "Central and Eastern European Financing Fund" led by Taiwan’s National Development Council, strengthens bilateral ties. As demand for industrial products rebounds post-pandemic, Central Europe's projected growth in machine tool demand (nearly 5%) offers significant opportunities for Taiwan’s smart manufacturing sector.