CIMES 2024 - China International Machine Tool Show – Observations on Taiwan’s Business Opportunities

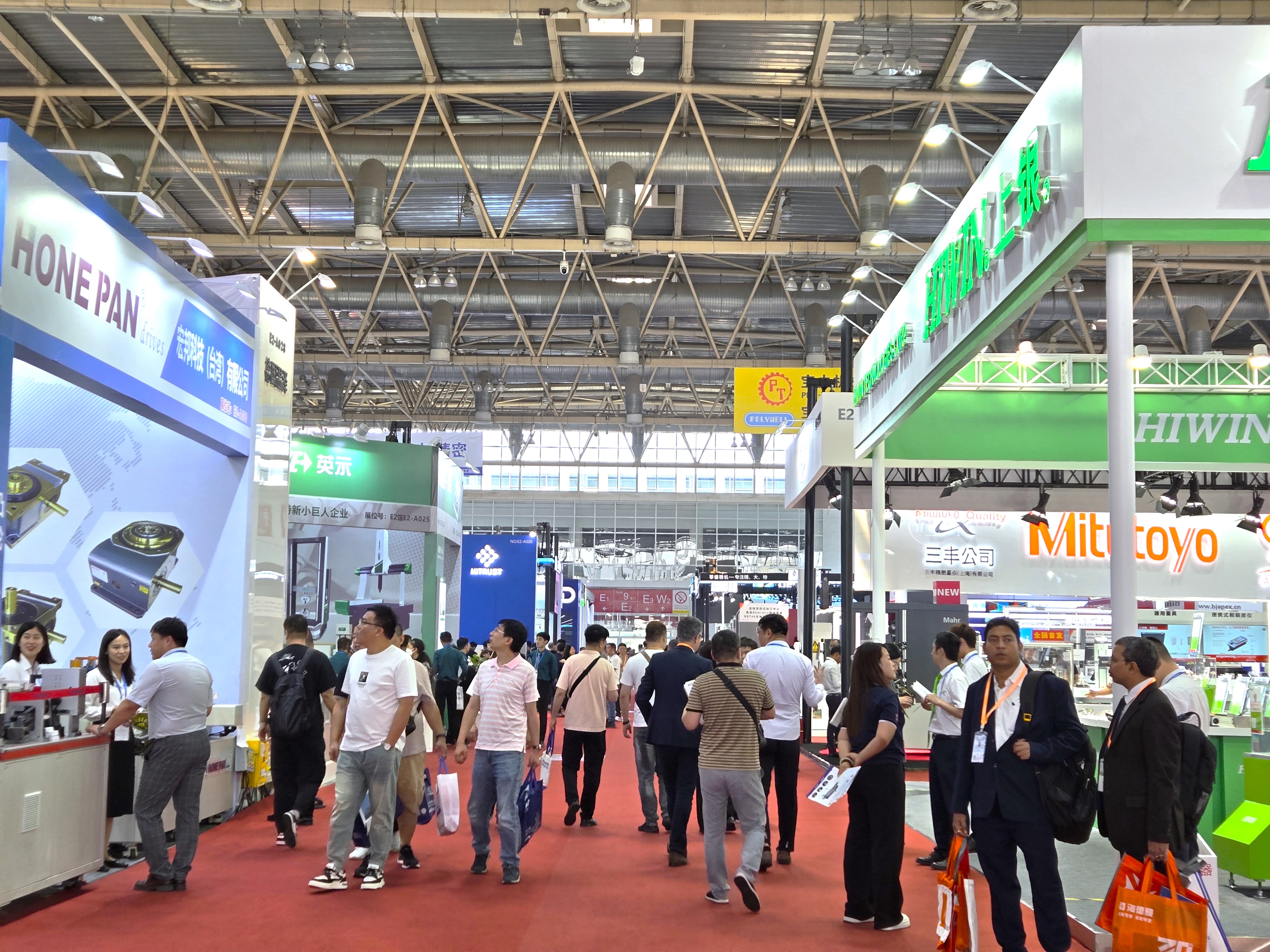

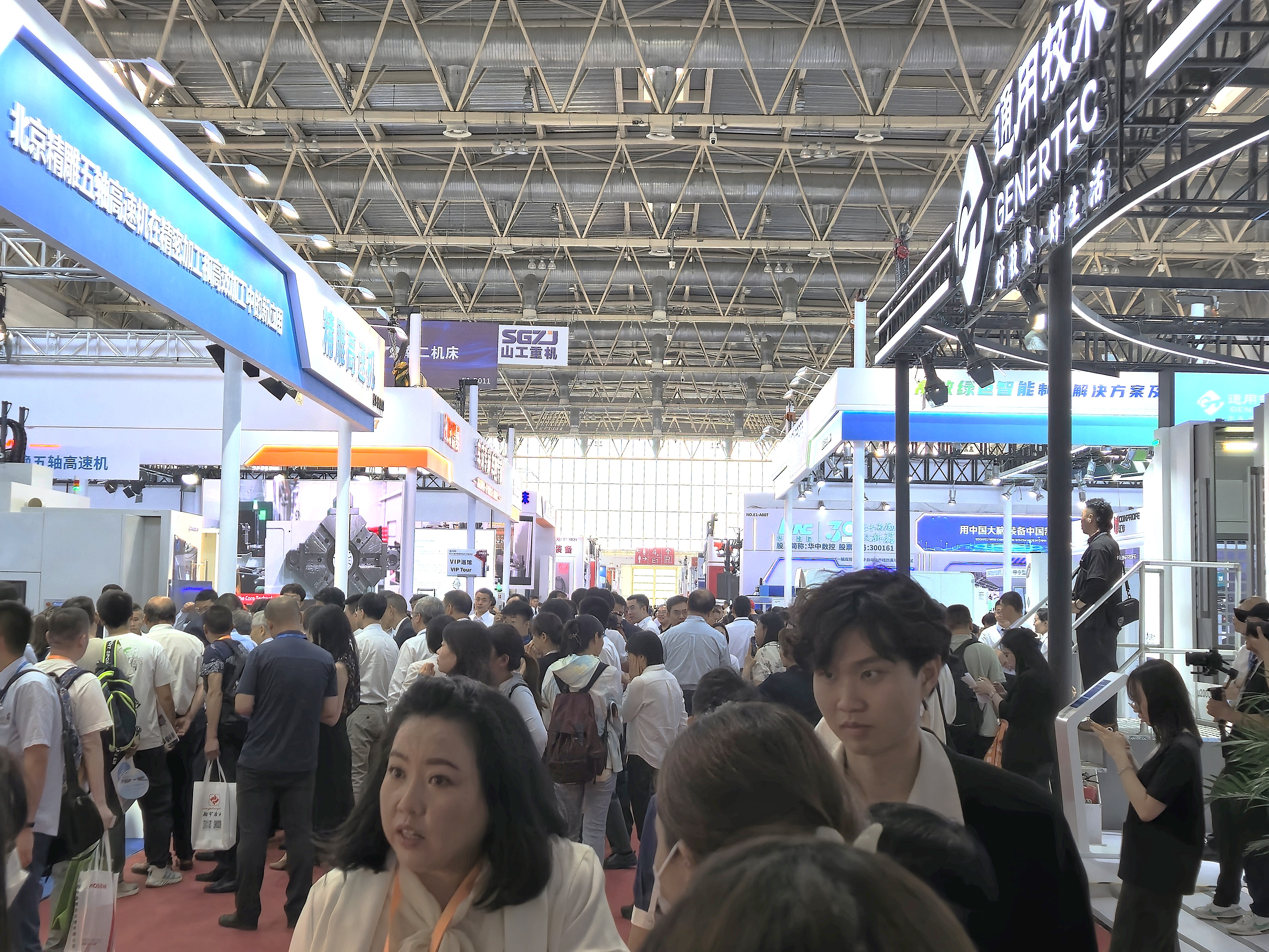

The China International Machine Tool & Tools Exhibition (CIMES) has been held in Beijing every even-numbered year since 1992, except for 2020 and 2022 when it was suspended due to the pandemic. After a six-year hiatus, it returned from June 17 to June 21 at the China International Exhibition Center (Shunyi Hall) in Beijing. This year’s theme was “Digital, Future, Technology, Innovation,” focusing on high-end, intelligent, and green development. Exhibits covered metal cutting equipment, sheet metal forming equipment, cutting tools, measurement systems, machine tool accessories, industrial automation, and smart factories. The show featured about 1,000 exhibitors, with a total display area of 70,000 square meters and attracted approximately 70,000 visitors.

Compared to 2018, the exhibition area was smaller by 50,000 square meters, with 300 fewer exhibitors. Attendance was relatively quiet except for the first two days, and foreign visitors were scarce. The main crowds gathered in Hall E1 at booths of General Group, Beijing Jingdiao, and Hexagon. The event hosted 25 seminars, among which the “Integration of Informatization and Industrialization Promotion Conference & New Round of Large-Scale Equipment Renewal Seminar,” the “Green and Low-Carbon Technology Innovation Forum for the Motor Industry,” and the “Industrial Mother Machine Common Technology Innovation Forum” were packed, each drawing about 300 participants. Attendees were actively taking notes and photographing slides, showing strong interest in economic trends, machine tool market development, customer needs, and technology directions.

Emphasis on Precision – Rise of Domestic Measurement Instruments

Key international exhibitors included EMAG, Sodick, WTO, SCHAEFFLER, Mitutoyo, and Hexagon, while Kitamura, Nidec, Brother, Nakamura-Tome, and Kitagawa participated through agents. Taiwan exhibitors organized by TMBA included Takisawa Taiwan, Chiah Chyun, Hiwin, PMI, Hung Chun Cutting Tools, Yuan Li Electromagnetic, Shieh Chien, and Hung Jyu (Yin Shih); others such as Ching Hung, Hsiang Yang, Fu Yu, Tan Jia, Cheng Ho Yuan, and Maru Ryo registered independently. Chinese exhibitors included Genesis Group’s Taikan, Beijing Jingdiao, General Group, Huazhong CNC, and Haomai.

Halls E1 and E2 gathered major brands, but the main aisle was dominated by measurement instrument manufacturers—nearly 20 international and Chinese companies. Inquiries revealed that China is increasingly emphasizing precision; when accuracy falls short, measurement equipment compensates. Since imported measuring devices face restrictions, domestic manufacturers are rising rapidly. Halls W2 and W3 featured talent development zones and a “High-End CNC Machining Technology Competition,” where students used Chinese-made Shandong Chenbang machine tools paired with Kaiendi controllers for live machining, showcasing China’s mid-to-high-end machine tools and controllers while cultivating skilled talent.

Taiwanese Brands Still Favored

Most exhibitors did not align with the green or digital themes; the most evident trend was “targeting high-end development.” All major brands showcased five-axis machines and horizontal machining centers. Only one large machine—a Tide 8.2-meter gantry three-axis milling machine—was displayed. However, most key components such as spindles, tool magazines, linear guides, ball screws, and rotary tables were still predominantly sourced from Taiwanese brands.

Aside from Beijing Jingdiao using its own controller, others featured Siemens 828D, Mitsubishi M80, Fanuc, Syntec, Huazhong CNC, and Guangzhou CNC, with Heidenhain appearing on only one machine. Taikan revealed that Syntec controllers rank third among Chinese end-users, after Siemens and Mitsubishi, thanks to affordability, ease of use, and higher precision compared to Huazhong CNC. Annual sales in southern China reach about 100,000 units.

Built-in spindles were mainstream, supplied by Kessler, Ro-Yi, Jian-Chuan, Pusen, and Guangzhou’s Haozhi, which is gaining traction. Many exhibitors marketed themselves under Taiwanese branding or appeared similar, misleading visitors into thinking they were mid-to-high-end equipment—for example, Dongguan–Taiwan High-Tech (linear guides), Xinxiang–SKF Skyfu (grinders), Shandong–Taiwan Precision (linear guides), Shandong–Tiger (rotary tables), and Daying Syntec (lathes). Daying Syntec even used Syntec controllers and Lianda robotic arms exclusively, causing confusion.

Leading Chinese Machine Tool Players

Beijing Jingdiao promoted complete solutions, offering high-precision, high-speed mid-to-high-end machines, robotic arms, on-site storage, and machining simulation software. Its software R&D team exceeds 100 employees, and it manufactures all critical components—controllers, spindles, rotary tables, and tool magazines—aiming to make customers fully adopt Jingdiao products for automotive, 3C, and mold industries.

Genesis Group’s Taikan reported 2023 revenue of 3.3 billion RMB, ranking first in China. Its booth was divided into mass-production and specialized machines. Mass-production models used Siemens-based controllers with secondary development, featuring machines like a small vertical lathe with a 25,000 rpm spindle, convertible to a milling machine with a turret, horizontal machining centers with 630 mm tables, and 3+1-axis milling machines with 1,000 rpm rotary tables. Specialized machines included dual-spindle vertical machining centers with Mitsubishi M80 controllers, triple-spindle models with Huazhong controllers and Haozhi built-in spindles, and low-Z-axis gantry designs with Syntec controllers for high rigidity, precision, and speed—targeting Jingdiao’s high-speed precision machines.

General Group aimed to become a globally competitive enterprise. Post-group restructuring, its exhibits were fewer but diverse, focusing on high-end markets and import substitution. Highlights included five-axis horizontal machining centers with 800 mm tables and Huazhong controllers, three-axis horizontal centers with Fanuc controllers, five-axis EDM machines, and vertical boring mills with 900 mm tables and Huazhong CNC. Other displays included optical scales and Fanuc wire-cut machines.

Baoli Machinery, a major Chinese agent, strives to be the best service provider in China’s machinery industry. It showcased Japanese brands like Brother and Nidec OKK, as well as Taiwanese machines. Sales staff noted that southern China particularly favors Brother machines, often ordering in batches of 1,000 units.

Overview of Chinese Market Demand

Many Chinese machine builders indicated that the termination of ECFA will affect costs—like a double-edged sword. Since Chinese components still lag behind Taiwan’s, they may prioritize Taiwanese firms with local factories. Syntec controllers are well-received in China and worth considering for market entry.

In 2024, China’s State Council launched a new large-scale equipment renewal program, allocating 5 trillion RMB for provincial implementation to boost domestic demand and strengthen Chinese machine tool makers, mandating replacement of machines over 10 years old. Southern China shows strong demand, purchasing mid-to-high-end machines in bulk. Taiwanese machine tools are positioned as mid-to-high-end in China, but competition in southern processing markets is fierce—speed and price dominate. Compact, high-speed machines paired with robotic arms are preferred.

Chinese machines generally suffer from poor precision, losing accuracy after about three years, and MTBF awareness remains low. Taiwanese manufacturers should continue promoting quality standards while improving compensation and online measurement technologies.

China remains indifferent to carbon emission issues like CBAM; only Huizhuan showcased green machine tools. Taiwanese machine tool makers must keep advancing dual-axis transformation and developing value-added solutions to widen the gap with Chinese competitors.

|

|

|

|