American Storm: Risks and Responses Under Trump 2.0

By Industry Analyst / Su Hanyang

The Political and Economic Landscape Under Trump 2.0

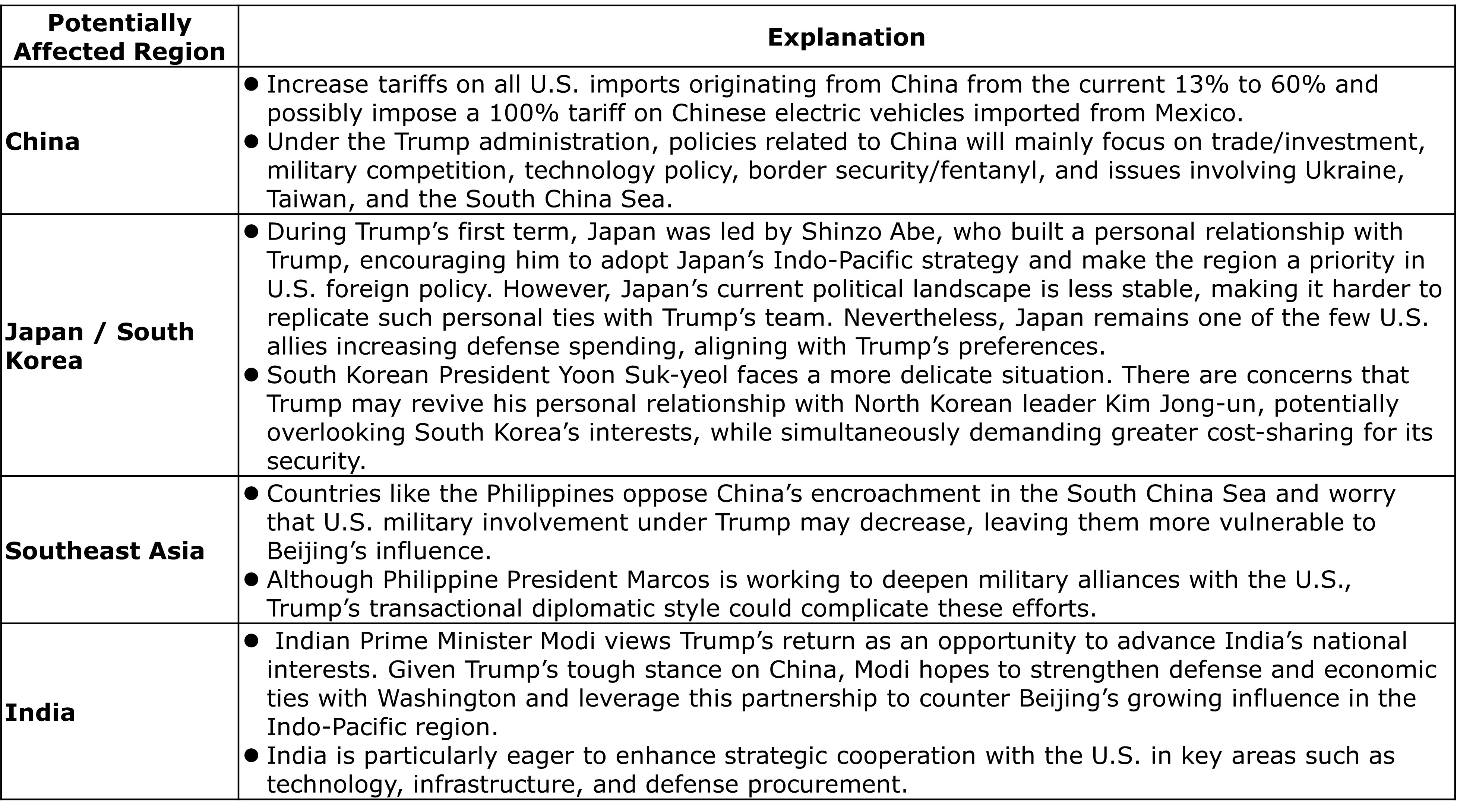

After winning the 2024 U.S. presidential election, Trump will take office in January of the following year. His return has sparked significant unease among Washington’s allies and Asian competitors. During his first term (2017–2021), unpredictability was a hallmark of Trump’s foreign policy: he sought to promote dialogue between North and South Korea while simultaneously escalating U.S.-China tensions and withdrawing from key regional agreements.

Since his departure in early 2021, the world has changed dramatically: COVID-19’s supply chain challenges have elevated economic resilience to a national security issue, while conflicts in Ukraine and the Middle East dominate global affairs. This shifting landscape, combined with evolving power dynamics, will inject greater uncertainty into global politics and economics.

U.S. partners in Asia anticipate that Trump’s return may reduce American engagement in the region. He is expected to adopt a tougher stance on China while scaling back military involvement in the Indo-Pacific and favoring bilateral deals over multilateral platforms like the Indo-Pacific Economic Framework (IPEF). In contrast, the Biden administration prioritized strengthening networks of Asian partnerships to counterbalance China’s influence. This shift will force Asian allies to adapt to a new, more transactional era of U.S. diplomacy, where economic deterrence through bilateral agreements takes precedence over military deployments.

|

Source: Various research institutions, compiled by the author (2024)

Trade War Likely to Escalate

Trump’s second term will differ significantly from his first. Previously, his priorities included addressing trade imbalances, renegotiating NAFTA (now USMCA), and launching a trade war with China by imposing tariffs on $370 billion worth of imports. Backed by Republican majorities in Congress, Trump could now implement sweeping changes to bilateral and global trade arrangements, including universal tariffs and steep hikes on Chinese goods.

Congress has delegated certain trade powers—such as imposing tariffs—to the president, enabling Trump to act without legislative approval. He used these powers aggressively in his first term and vows to expand their use. His popular vote margin of 5 million further strengthens his mandate.

The “America First” trade doctrine enjoys bipartisan and public support. Biden even retained Trump-era tariffs on Chinese goods and introduced export controls on critical technologies like semiconductors and quantum computing. This continuity bolsters Trump’s ability to enforce protectionist policies against China and other partners.

Analysts note that Trump’s previous tariffs had limited impact on China, making it likely he will double down in his second term. A more intense U.S.-China trade war could severely disrupt Chinese exports, investment, and tech development, while increasing supply chain risks globally—hurting third-party economies like ASEAN, which supply raw materials and components to China.

China may retaliate by targeting U.S. exports of agricultural products, pharmaceuticals, autos, and machinery, though energy exports may remain untouched due to the global energy crisis. Additional measures could include interest rate cuts, currency depreciation, tax reductions, and fiscal support for local governments. However, China’s current economic woes—property bubble collapse, weak consumption, and slowing growth—make recovery harder than in 2016.

|

Europe in the Crosshairs

The EU may also face Trump’s tariffs. European nations could respond by boosting defense spending to 2% of GDP, fostering cooperation among countries with strong defense industries (France, Italy, Spain, Poland), spurring innovation and growth while improving bargaining power with Trump.

Trade tensions loom large: EU exports to the U.S. total $1.3 trillion, compared to $758 billion with China. Machinery, vehicles, and chemicals—68% of EU exports to the U.S. in 2023—are most vulnerable. Germany, the Netherlands, Ireland, and Belgium face the greatest risk, threatening already sluggish growth. Lacking strong countermeasures, the EU may pivot to other markets, such as ratifying the Mercosur agreement and seeking regional alliances to reduce U.S. dependence.

Country Case Study: Vietnam

Vietnam, a rising manufacturing hub and key U.S. trade partner, has benefited from U.S.-China tensions, attracting billions in FDI across textiles, semiconductors, and more. Trump’s proposed 60% tariff on Chinese goods could make Southeast Asia even more appealing as an alternative production base.

Vietnam has rapidly climbed the value chain, expanding into semiconductors and autos. Companies like Samsung and Intel have increased investments to mitigate U.S. tech restrictions on China. Vietnam now accounts for nearly 40% of ASEAN exports to North America.

Trump’s personal affinity for Vietnam—evident from his visits and business ventures—adds another layer. His group recently partnered with KBC to build a $1.5 billion complex in northern Vietnam, including a hotel, luxury golf course, and residential area. Meanwhile, Elon Musk’s SpaceX is making Vietnam a key production center for its Starlink satellite network, shifting suppliers from Taiwan to Vietnam to reduce geopolitical risk.

However, Vietnam’s large trade surplus with the U.S. could become a liability if Trump’s populist rhetoric targets it, as happened with Mexico and the EU. Vietnam is America’s third-largest trade surplus partner after China and Mexico. Additionally, concerns over Chinese goods transshipped through Vietnam under dubious origin rules have prompted Hanoi to tighten standards to avoid future tariff penalties.

How Businesses Should Respond

Multinationals and firms reliant on cross-border flows must treat geopolitical risk as urgently as digitalization, AI, and climate challenges. Companies should build resilience and agility by stress-testing investment and operational plans against potential disruptions.

Key steps include:

- Develop industry-specific scenarios to forecast business conditions.

- Use data analytics and third-party intelligence to create “indicators” as early-warning systems for major events (e.g., military actions, tariff hikes) and subtler shifts (e.g., leadership changes, new legislation).

- Formulate contingency plans for rapid response when alerts arise.

- Establish specialized geopolitical teams—typically 2–3 experts in international relations, global policy, supply chain, and risk management—and supplement with external advisors or independent directors as needed.